With in-house global trade and compliance expertise, Passport breaks down how the April 2025 tariff announcements are creating new challenges for international ecommerce — and what brands can do to adjust their strategies.

The Trump administration announced major changes to U.S. tariff policy throughout April 2025 – making waves across global ecommerce. A 10% blanket tariff on all imports, the end of de minimis for China and Hong Kong on May 2nd, and escalating reciprocal tariffs for dozens of countries have created one of the biggest shake-ups in recent trade history.

For ecommerce brands selling internationally, the consequences are already unfolding: higher costs, supply chain disruptions, and stricter customs requirements. According to a recent research survey conducted by Passport in partnership with Drive Research, *81% of ecommerce decision-makers say shifting tariffs and regulations could put their global strategy at risk.

With the loss of duty-free shipping and greater complexity at the border, brands must quickly rethink pricing, fulfillment, and logistics. Now’s the time to take a proactive approach — before these changes start cutting into profit margins and affecting customer experience.

Key Trade Policy Updates Announced in April 2025

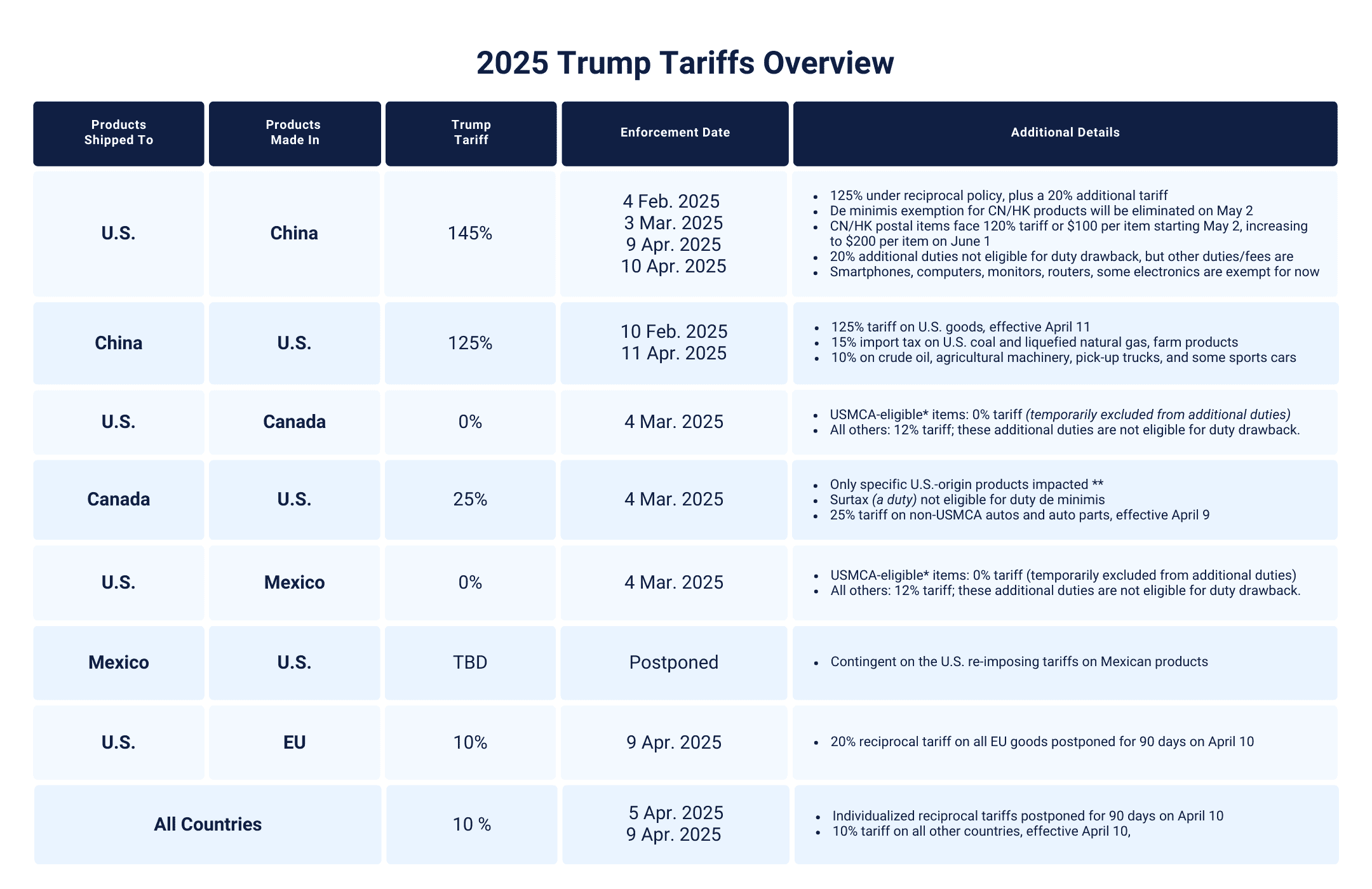

- A 10% blanket tariff applies to all U.S. imports except Canada, Mexico, and China as of April 5.

- Country-specific rates are frozen for 90 days. As of April 10, the 10% tariff also applies to countries previously subject to reciprocal tariffs.

- China and Hong Kong are the exception: a 125% reciprocal tariff applies to imports from these markets as of April 10, in addition to the 20% tariff imposed in March for a total 145% tariff; this is addition to other standard tariffs (Smartphones, computers, monitors, routers, and some electronics are exempt for now).

- Postal shipments from China and Hong Kong will be subject to a 120% tariff or $100 per item (carrier selects method) starting May 2. This increases to $200 per item on June 1.

- De minimis ends May 2 for all China and Hong Kong products. All goods, regardless of value, will require formal or informal entry.

- The U.S. still plans to eliminate de minimis benefits for all countries once systems are ready to support full enforcement.

Want a deeper breakdown of trade developments?

Industry experts Thomas Taggart and Agustin Farias unpack the end of de minimis and the rollout of reciprocal tariffs in the latest Trump Tariff Talk webinar. Their discussion dives into the broader trade implications and offers practical insights for ecommerce brands navigating this evolving landscape.

Understanding Tariffs and De Minimis

What are Tariffs?

Tariffs are taxes or duties imposed by a government on imported goods. They’re used to generate revenue, protect domestic industries, or influence foreign trade relationships. Most tariffs fall into two categories:

- Ad valorem tariffs are calculated as a percentage of the product’s declared value – for example, a 10% tariff on a $1,000 item would result in $100 in duties.

- Specific tariffs are a fixed amount charged per unit, no matter what the item is worth – for example, $2 per item, whether it costs $10 or $100.

What is De Minimis?

De minimis refers to the threshold below which imported goods can enter a country duty-free or with simplified customs clearance. For ecommerce brands, this threshold plays a key role in keeping cross-border shipping cost-effective, especially for low-value, direct-to-consumer (DTC) orders.

Since 2016, the U.S. de minimis threshold has been $800 USD per person, per day, offering a significant advantage to ecommerce brands by reducing landed costs and avoiding delays through a simplified customs clearance process.

What’s Changing in 2025: De Minimis and Tariff Updates

The trade policy updates announced on April 2, 2025, mark a substantial adjustment in how ecommerce imports are taxed and processed at the border. Brands that ship globally need to keep up with these critical developments to avoid added costs and compliance issues.

De Minimis Is Ending

The U.S. government has confirmed plans to eliminate the de minimis exemption for all countries once customs systems are equipped to support full enforcement. For now, the most immediate changes apply to shipments from China and Hong Kong:

- May 2, 2025: De minimis ends for all China and Hong Kong products – shipments of any value will require formal customs entry and duties. Postal shipments will face a 120% tariff or $100 per item, depending on the valuation method selected by the carrier.

- June 1, 2025: The postal tariff increases to $200 per item.

These updates phase out a long-standing cost-saving tool for DTC brands shipping low-value parcels and are expected to significantly increase landed costs for many ecommerce businesses.

New Tariff Rules Taking Effect

Alongside the end of de minimis benefits, a series of new tariffs are being introduced in phases – some of which are already in effect, with more to come in the weeks ahead.

- A 10% blanket tariff applies to all U.S. imports as of April 5 except Canada, Mexico, and China which are handled separately.

- The 10% rate also applies to countries previously designated for reciprocal tariffs — the country-specific rates are frozen for 90 days as of April 10th.

- Imports from China and Hong Kong are subject to a 125% reciprocal tariff, effective April 10, in addition to the 20% tariff imposed in March and any other standard tariffs that apply. Smartphones, computers, monitors, routers, and some electronics are exempt for now.

View the full U.S. Tariff Rates by Country list

How Will the April 2025 Tariffs Impact Ecommerce Brands?

For merchants, the implications of these new tariffs and the end of de minimis will depend heavily on sourcing, fulfillment models, and shipping strategy. Understanding how these policy updates affect different business types is key to identifying the right operational adjustments.

Brands Shipping China-Made Products to the U.S.

What to Expect:

- A 125% reciprocal tariff, effective April 10 — on top of the 20% in additional tariffs introduced earlier this year, as well as any previously existing duties that may still apply

- The end of de minimis on May 2, removing duty-free entry for low-value shipments

- Postal shipments from China will be subject to duties beginning May 2, with a rate of 120% or $100 per item — increasing to $200 per item on June 1

Biggest Challenges:

- Rising landed costs on low-value, high-volume shipments

- Increased customs complexity and longer clearance times

- Pressure to increase prices or change fulfillment strategies

Brands Shipping China-Made Products but Fulfilling from the U.S.

What to Expect:

- Higher import costs when bringing inventory into the U.S. from China

- Fluctuating freight costs as carriers respond to shifting demand – including early spikes as brands rush to reposition inventory, followed by potential drop-offs

Biggest Challenges:

- Balancing higher U.S. duties with continued cross-border shipping costs

- Need for more agile fulfillment options across North America

- Maintaining predictable landed costs to support consistent pricing strategies

U.S.-Made Products Shipped to Canada & Mexico

What to Expect:

- Canada’s 25% retaliatory surtax on select U.S.-origin goods is now in effect, as of March 4

- Mexico may impose similar tariffs depending on future U.S. policy moves

Biggest Challenges:

- Uncertainty around tariff timing and enforcement

- Potential impact on price competitiveness in North American markets

Brands Sourcing Outside of China (e.g., Vietnam, India)

What to Expect:

- Continued access to the U.S. $800 de minimis – for now (though bulk imports are subject to reciprocal tariffs, including 10% for Vietnam and India)

- A planned global phaseout of the de minimis exemption once systems are in place

Biggest Challenges:

- Uncertainty around how long de minimis benefits will last

- Need for long-term contingency plans around sourcing and shipping models

What to Do Next: Smart Moves for Ecommerce Brands

Whether importing from China, fulfilling regionally, or managing multiple international markets, there are steps every ecommerce brand can take now to stay ahead of these changes.

1. Adjust Pricing & Duty Calculations

Make sure your storefront reflects new tariffs and duties clearly – either built into product pricing or broken out at checkout.

2. Consolidate Shipments Where Possible

Reduce brokerage fees and customs processing costs for orders that are not eligible for de minimis exemption by bundling orders into formal entries instead of multiple low-value shipments – especially as de minimis thresholds disappear.

3. Review Your Import Strategy

Evaluate whether a “first sale” valuation for U.S. imports (where duties are based on the price paid to the original manufacturer) could help lower your duty liability. This method requires careful compliance with documentation, export designation, and proof of bona fide sales.

4. Shift to In-Country Fulfillment

Reduce tariff exposure and delivery delays by warehousing inventory within your key markets. In-country fulfillment can improve customer experience and shield your brand from ongoing cross-border disruptions.

5. Optimize Country of Origin & HTS Classifications

Review your sourcing countries and product design to minimize duties and take advantage of preferential trade agreements where applicable. Accurate HS codes and country of origin documentation are essential for compliance and long-term cost savings.

6. File for Duty Drawback on Exports

If you’re re-exporting goods that were taxed at import, you may be eligible to recover duties paid. Duty drawback allows merchants to recover 99% of duties and fees paid on goods that are imported and then subsequently exported in the same condition. This can also apply to raw materials and packaging that are imported into the U.S. and used to manufacture a finished product.

Navigating an Evolving Era of Ecommerce

The April 2025 tariff changes mark a turning point for cross-border ecommerce. As tariffs rise and de minimis benefits disappear, brands must rethink their global strategies to protect profitability. Success in this new environment will depend on operational flexibility, smarter fulfillment models, and a clear understanding of international trade dynamics.

To keep up with these changes, TrumpTradeTracker.com provides real-time updates on policy announcements, tariff shifts, and expert insights into what they mean for global commerce. It’s a practical resource for following developments as they unfold — and for understanding how they could shape the future of international selling.

In a more complex and regulated trade environment, long-term success will belong to brands that stay informed, adapt early, and plan ahead.

* This article includes findings from an online survey conducted by Drive Research in partnership with Passport. The study surveyed 100 U.S.-based ecommerce decision-makers between February 13 and March 7, 2025, to assess global expansion plans, regulatory concerns, and operational challenges. The results carry a margin of error of ±10% at a 95% confidence level.

Authored by Thomas Taggart

Head of Global Trade | Passport

Thomas Taggart is a cross-border commerce leader with more than 20 years of experience in international shipping and regulatory affairs. As the Head of Global Trade, Thomas helps ecommerce brands go global by simplifying international trade, tax, and product compliance issues. Prior to Passport, he brought international shipping solutions to market through multiple roles in UPS’s product development organization.