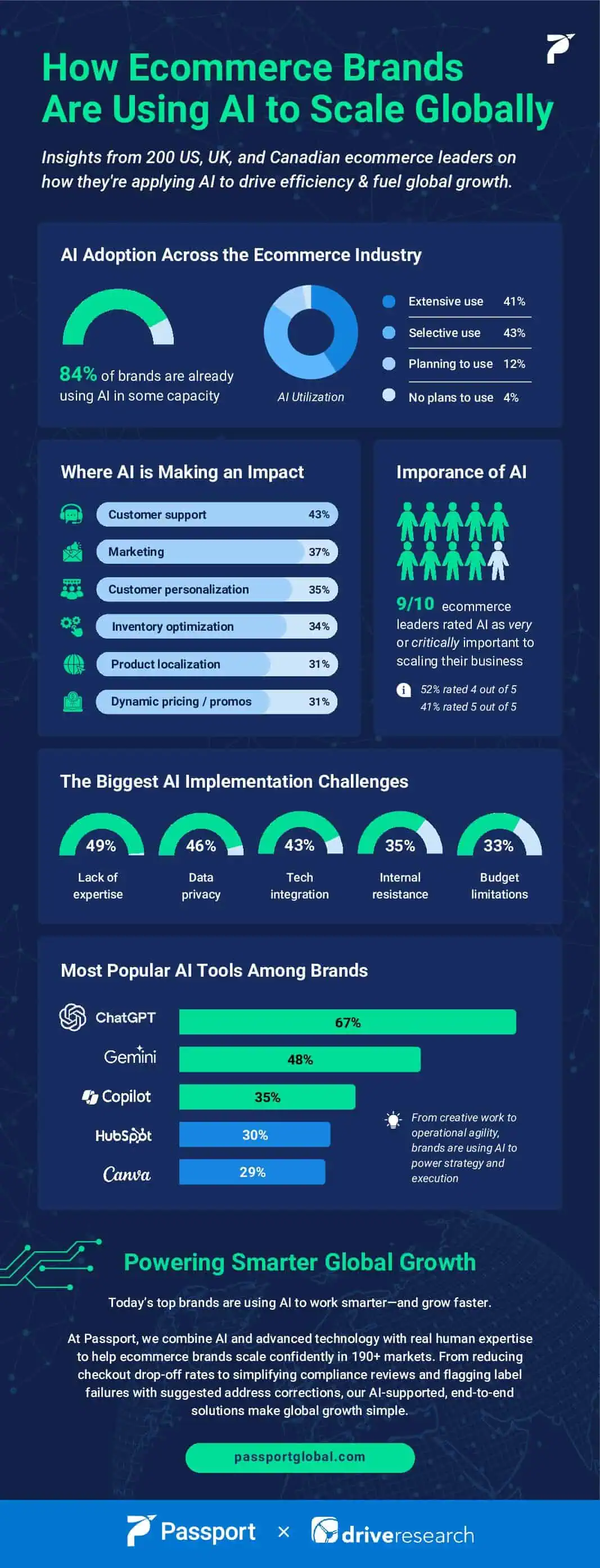

AI is transforming ecommerce at record speed. What started with chatbots and recommendation engines has evolved into a network of advanced tools that now influence everything from how shoppers browse to how brands engage and convert them. A study of global ecommerce leaders conducted by Passport in partnership with Drive Research found that 84% of brands have already adopted AI across key customer-facing areas such as marketing, personalization, and support. But as the front-end of ecommerce grows more sophisticated, pressure is mounting on fulfillment, compliance, and delivery operations to keep pace.

AI Is Redefining How Shoppers Discover, Decide, and Buy

AI is becoming deeply embedded in how people shop, influencing more moments of the buyer journey than ever before. What began with simple personalization algorithms has evolved into systems that anticipate intent and remove friction from the buying process. Adobe forecasts a 520% surge in AI-assisted online shopping this holiday season—evidence of how quickly consumers are embracing these advancements.

The traditional sales funnel is beginning to collapse as once-separate steps—search, comparison, and checkout—converge into a single, seamless interaction. Tailored suggestions and predictive analytics now guide shoppers before they even begin searching, while dynamic pricing and real-time merchandising adjust instantly to sustain engagement. Plus, emerging tools like ChatGPT’s Instant Checkout are introducing a new era of conversational shopping—where a customer might simply ask, “Can you find me a pair of leather boots under $100?” and complete the purchase within the same chat.

However, almost every major platform has experimented with native checkout in recent years. For example, Google’s Buy on Google and Meta’s Facebook and Instagram Shops both aimed to keep transactions within their ecosystems—but adoption remained limited as both merchants and shoppers gravitated back to brand websites. The exception is TikTok Shop, which reached roughly $9 billion in U.S. GMV and about $33 billion globally within just a few years—proving that integrated discovery and purchasing can work when the experience feels natural to the platform.

That history makes ChatGPT’s entry especially intriguing. Rather than forcing shopping into feeds or search results, it introduces something new—commerce through conversation. If successful, it could finally close the distance between search, consideration, and purchase, redefining not just how consumers shop but what they expect from every ecommerce interaction.

The Bottleneck Behind AI-Accelerated Demand

While AI is redefining how brands attract and convert customers, it’s also exposing the limits of their operational infrastructure. Quicker conversions and rising order volumes can’t sustain growth without the operations to support them.

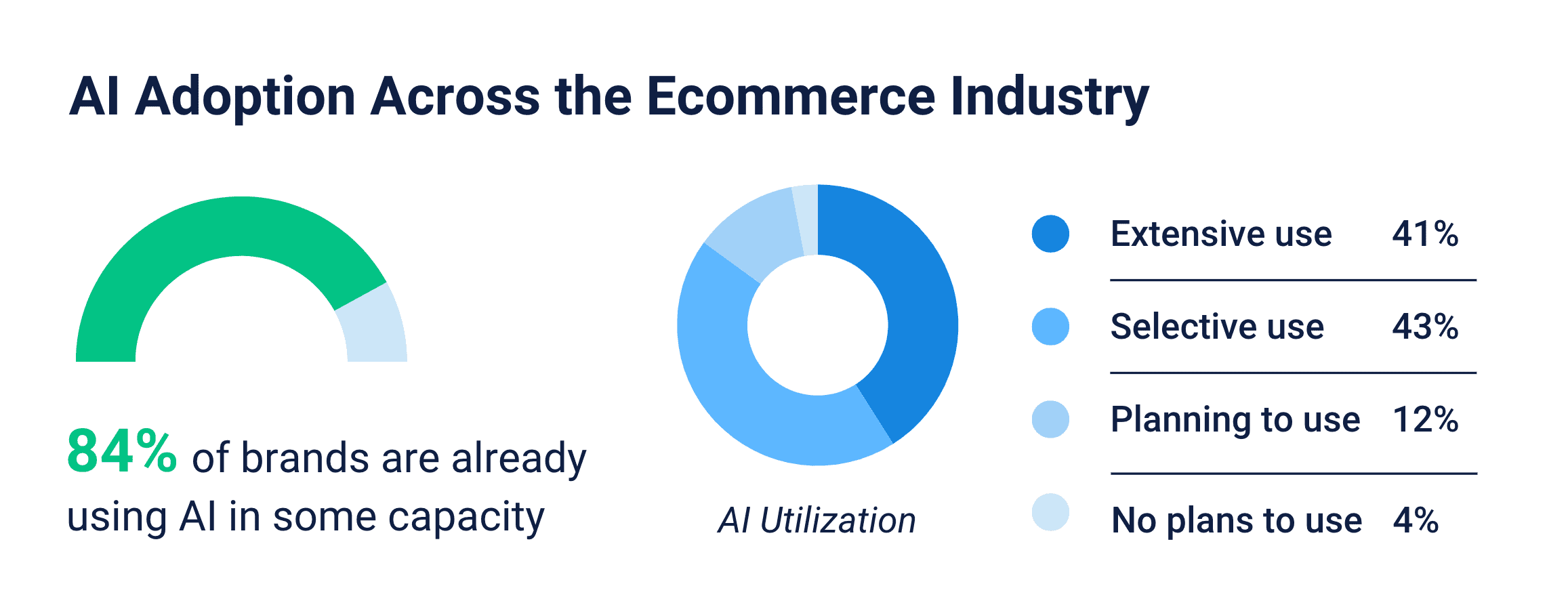

According to Passport’s study, many ecommerce leaders are still lagging behind the curve. Only about one-third use AI for inventory optimization, and even fewer have applied automation to compliance or cross-border logistics. The result: AI may be accelerating performance on the front-end, but it’s amplifying pressure on the back-end—where most inefficiencies still live.

Fulfillment networks are being tested by more dynamic order volumes, tighter delivery windows, and the rising complexity of global compliance. Every faster checkout requires quicker movement of goods; every predictive promotion adds uncertainty to inventory planning. As ecommerce becomes increasingly AI-driven, the brands that succeed will be the ones that connect what drives demand with what delivers it.

Delivering on AI-Driven Growth

From automatic translation to localized pricing and predictive modeling, new tools are making it easier to sell across borders and reach customers in more markets than ever before. But as the path to purchase gets easier, the delivery process is becoming more complex.

Another report from Passport and Drive Research found that 91% of merchants view international sales as a profitable revenue stream, yet few feel equipped to manage the expanding layers of compliance, taxation, and cross-border logistics that come with it. The same AI systems that accelerate discovery and checkout are now revealing cracks in how global operations are managed.

New de minimis rules, reciprocal tariffs, and shifting import requirements are testing even the most established brands. Those relying on traditional fulfillment models are finding it harder to adapt to local market needs and fluctuating costs. Meeting the promise of AI-powered growth requires more than automation at checkout—it requires efficient and agile infrastructure to support it.

Connecting Intelligence and Infrastructure

The next wave of standout ecommerce brands will be those that align automation with accountability—connecting predictive insights at the point of sale to precision in how every shipment moves, clears, and arrives.

Success in this new era won’t come from just selling faster, but from delivering smarter. The brands that thrive will use AI to unify marketing, checkout, fulfillment, and compliance into a single, cohesive flow—where insights translate into action and operational decisions move as quickly as customer expectations.

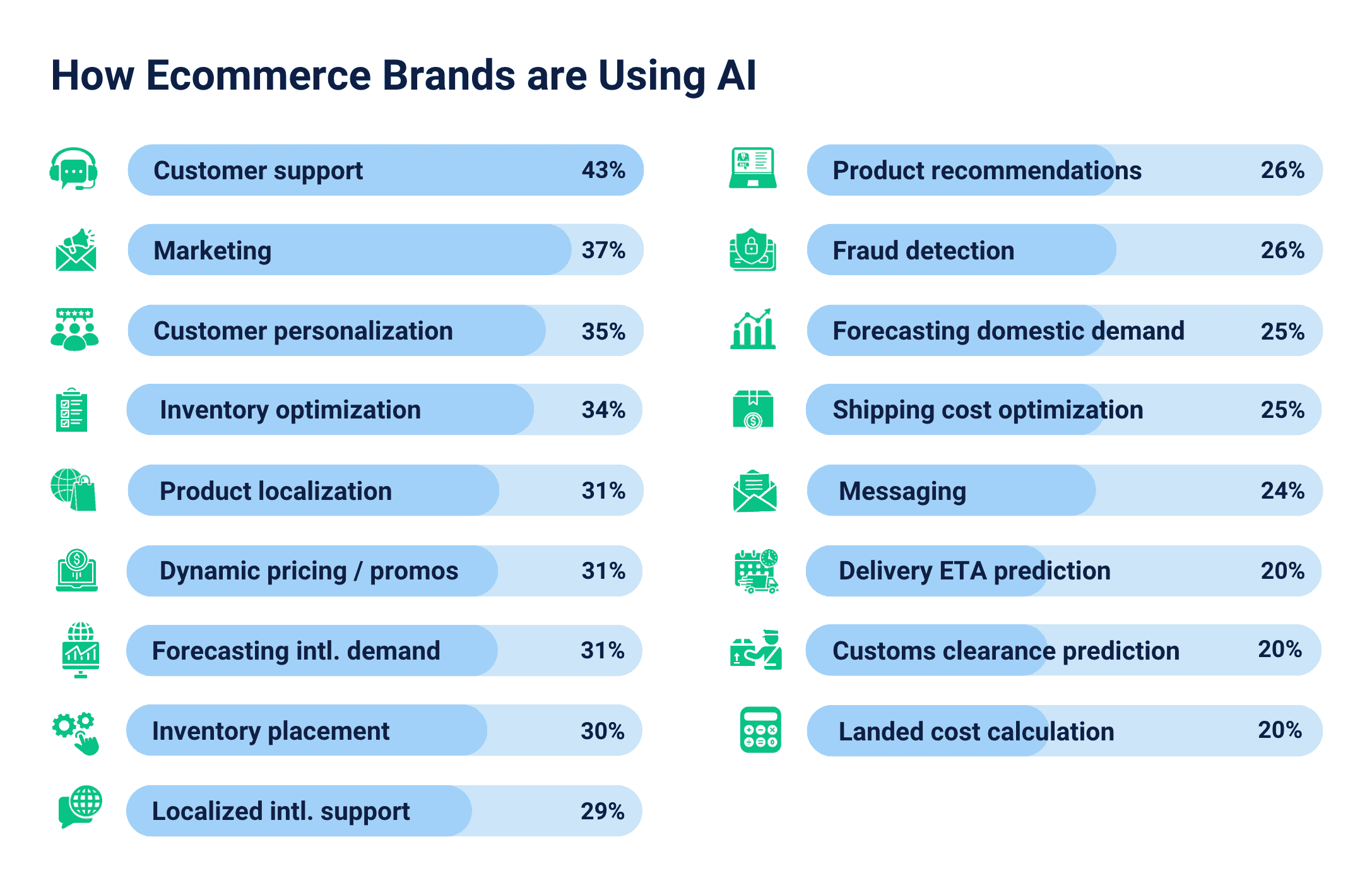

That’s easier said than done though. Nearly half of ecommerce leaders cite a lack of expertise as their biggest barrier to operational adoption—a gap that technology alone can’t close. Partnering with experts who understand the nuances of global shipping, tax, and compliance can turn AI-driven growth into sustainable performance.

While AI is making ecommerce more efficient, the real opportunity lies with those ensuring every part of the operation keeps pace—building the infrastructure to match the intelligence.

Authored by Alex Yancher

Co-Founder & CEO | Passport

Alex Yancher is an accomplished entrepreneur and business leader, currently serving as the Co-Founder and CEO of Passport. Prior to founding Passport, Alex held key positions such as Chief Operating Officer at Pantry, where he revolutionized fresh food retail. Alex has also held finance roles at companies like Facebook and Morgan Stanley. He also actively advises and invests in startups, offering strategic guidance and support.