The global trade landscape is quickly shifting as new tariffs and policy changes from the Trump administration create uncertainty for ecommerce brands and 3PLs. To help businesses navigate these challenges, Passport CEO Alex Yancher and global trade expert Thomas Taggart hosted a webinar breaking down the latest developments, common misconceptions, and strategies to mitigate risk.

With hundreds of registrations and a highly engaging Q&A discussion, this was an event not to be missed.

Here’s a recap of the key takeaways and what they mean for your business.

2025 Tariff Updates: What’s Changing?

The biggest change is the new 20% U.S. tariff on all Chinese-made goods, which went into effect immediately. Unlike previous tariffs, this applies to all products of Chinese origin, regardless of where they are shipped from.

In addition:

- China has retaliated with tariffs targeting U.S. energy products.

- Canada and Mexico faced potential 25% tariffs but received a temporary delay, with a final decision expected on March 4th.

- The U.S. has eliminated de minimis exemptions for China and Hong Kong, meaning all goods from these countries must now clear customs and pay duties.

These changes represent a major shift for ecommerce brands relying on direct-to-consumer (DTC) shipping from China.

Common Misconceptions & Clarifications

“Canada and Mexico are being hit harder than China.”

While Canada and Mexico were initially facing a 25% tariff, Chinese goods now face a cumulative tariff rate of up to 49% on certain products when factoring in previous duties.

“De minimis is gone for all countries.”

Not true! While China and Hong Kong shipments no longer qualify for de minimis, goods from all other countries still do – at least for now.

“USPS won’t accept packages from China anymore.”

USPS initially planned to stop accepting packages from China and Hong Kong, but they have since reversed that decision. However, formal clearance is now required for postal shipments, which could cause significant delays.

“Duty drawback is no longer an option.”

The additional 20% tariff imposed under this new policy is the only ineligible duty. Brands can still claim duty drawback and recover 99% of the duties and fees that were previously eligible.

How Brands Can Adjust Their Ecommerce Strategy

For brands impacted by these tariffs, there are a few options to optimize your shipping and fulfillment strategy:

1. Move to In-Country Fulfillment

One of the best ways to minimize duty exposure is to set up fulfillment centers in key markets like the U.S., Canada, and the EU.

- Instead of shipping each order individually from China, brands can import in bulk (paying duties on the cost of goods sold, not the retail price) and fulfill locally.

- This strategy helps reduce duty costs, improve delivery speed, and enhance the customer experience.

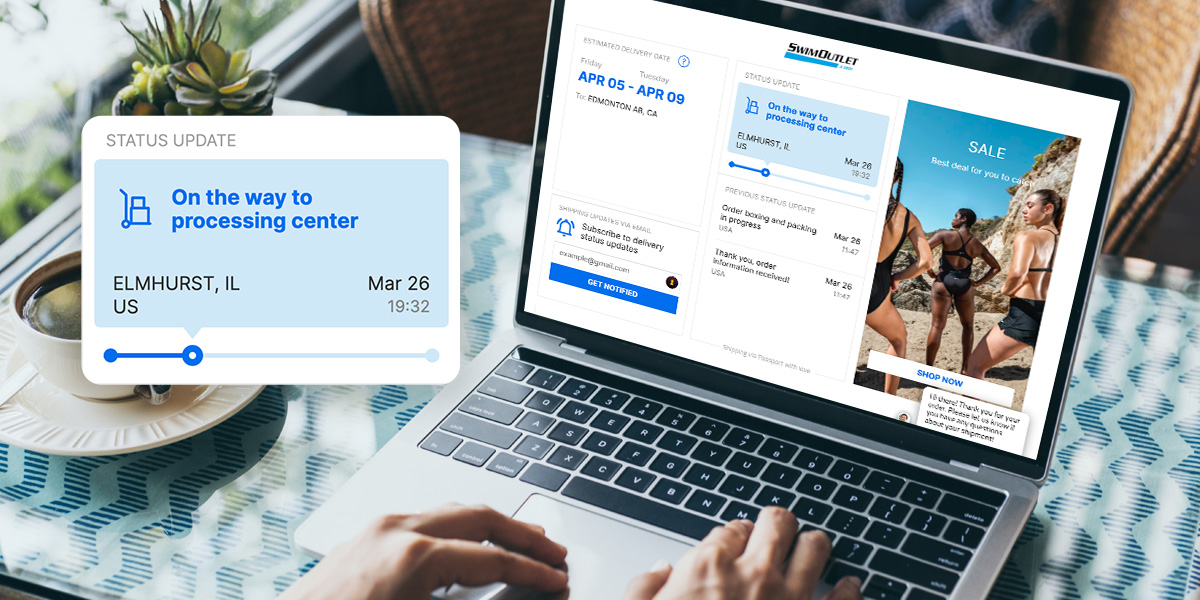

💡 Need help setting up in-country fulfillment? Passport recently expanded its offerings to provide fulfillment solutions in the U.S., Canada, the UK, Australia, and the EU.

2. Reassess Your Manufacturing Strategy

With China facing more trade restrictions, brands should explore alternative manufacturing locations such as:

- Vietnam & India (which still qualify for U.S. de minimis)

- Mexico (which offers duty-free imports under USMCA for certain products)

3. Switch to Delivered Duty Paid (DDP)

Given the increased scrutiny on customs clearance, Delivered Duty Paid (DDP) shipments can help brands avoid surprise duties for customers.

- This ensures all taxes and duties are prepaid and included in checkout pricing, leading to higher conversion rates and fewer abandoned carts.

4. Understand the First Sale Rule

Some brands are exploring whether they can declare the cost of goods sold (COGS) rather than the retail price when importing. While this may be possible, it is a complex legal gray area that could expose brands to significant risk if improperly applied.

- U.S. Customs and Border Protection (CBP) has previously ruled against brands attempting this for direct-to-consumer shipments, and audits could result in large back-tax liabilities.

- Best practice? Get an explicit ruling from CBP before attempting this strategy.

5. Verify Your HS Codes

If Canada moves forward with a retaliatory tariff, it will only apply to specific products. If your products aren’t listed, they won’t be subject to the 25% tariff.

- With thousands of Harmonized System (HS) codes, classifications vary based on product type, materials, and usage. Verifying your HS codes can help reduce landed costs and prevent compliance issues.

- Since duty rates differ by market, ensuring accurate classification is essential – some products may even qualify for reduced or zero-duty rates.

What’s Next?

- February 10, 2025: China’s 10%-15% tariffs on select US products effective

- March 4, 2025: Decision on Canada/Mexico tariffs

- April 1, 2025: Deadline for a broader review of de minimis policy changes

With more changes expected, brands must stay proactive to protect their bottom line.

Want real-time updates? Check out TrumpTradeTracker.com – a resource we created to track every tariff-related development.

Final Thoughts

The evolving tariff environment is complex, but brands that adapt quickly will be best positioned for long-term success. By shifting fulfillment strategies, diversifying supply chains, and optimizing customs processes, brands can mitigate the impact of these tariffs and continue to scale globally.

Need help with in-country fulfillment, global shipping, or tariff compliance? Reach out to our team to explore solutions tailored for your business.