The landscape of US trade policy has shifted dramatically in 2025. The end of de minimis for China and Hong Kong marked a turning point for ecommerce merchants. Rising tariffs, intensified enforcement, and new compliance requirements have created unprecedented cost pressures for ecommerce brands.

For many international brands – especially those selling apparel, footwear, cosmetics, supplements, and consumer electronics – these changes have forced a complete rethinking of US market strategies. What was once a straightforward direct-to-consumer model has become a complex maze of duties, tariffs, and compliance obligations.

But there’s a strategic opportunity hiding in plain sight. While most merchants are focused on minimizing tariffs, few have discovered Duty Drawback, a legitimate US government program that can recover up to 99% of duties and tariffs already paid. For brands navigating today’s volatile tariff environment, Duty Drawback represents a powerful tool to reclaim profitability and build resilience against future trade policy changes.

The Rising Cost of Doing Business in the U.S.: Why Tariffs Matter

The current tariff environment represents the new normal rather than a temporary disruption. Section 301 tariffs on Chinese goods remain in place, with rates ranging from 7.5% to 25% on various product categories. Recent policy developments have only added layers of complexity.

These costs don’t exist in isolation. They compound with other challenges: increased shipping costs, currency fluctuations, and the administrative burden of compliance. For brands that built their US market penetration strategy around low-cost, high-volume direct shipments, the current environment has fundamentally altered the profit equation.

Smart merchants recognize that tariff management isn’t just about minimizing current costs – it’s about building flexible systems that can adapt to continued trade policy evolution.

Duty Drawback Demystified: A Strategic Financial Tool

Duty Drawback is a legal US government program that allows importers to recover up to 99% of duties, tariffs, and fees paid on goods that are later exported, returned, or destroyed. The program was actually established in 1789 but it remains underutilized by ecommerce brands despite its significant financial benefits.

The concept is straightforward: if you pay duties on goods entering the US and later export those goods in the same condition, you can claim a refund of nearly all the duties paid. The program applies retroactively – claims can be filed for exports that occurred up to five years ago.

Three types of Duty Drawback are relevant to ecommerce merchants:

- Unused Merchandise Drawback applies to finished goods imported and later re-exported in the same condition. This is the most accessible option for ecommerce brands. A fashion retailer that imports clothing from Vietnam and later ships some of those items to customers in Canada or Mexico would qualify for unused merchandise drawback.

- Manufacturing Drawback applies if goods are used to manufacture something in the U.S. and the resulting product is exported. Used in manufacturing products that are then exported. This might apply to brands that import components and assemble finished products in the US before shipping internationally. For example, a cosmetics brand imports raw ingredients and uses those inputs to make finished products in a U.S. facility.

- Rejected or Destroyed Merchandise Drawback applies to defective or returned goods that are destroyed under customs supervision. This can help recover duties on products that never successfully entered the marketplace.

For most international ecommerce brands, unused merchandise drawback offers the clearest path to duty recovery. The key requirement is that goods must be exported in substantially the same condition as imported. If the imported product is used, altered, repackaged, assembled, or combined with other items before export, it no longer qualifies as “unused.”

Real-World Impact: The Numbers Behind Drawback

To see duty drawback in action, let’s take the example of a U.S.-based e-commerce company that imports finished footwear from China.

10% IEEPA reciprocal tariff

$125 Harbor Maintenance Fee (HMF)

Total = $29,975

- Retroactive filing allowed for up to 5 years

- Six to seven figures in total refunds for brands with regular exports

Since the company ships 10% of its inventory to international customers unused and in original condition, that portion becomes eligible for unused merchandise drawback. By claiming refunds on the applicable duties and fees, the company can recover money that would otherwise be lost. And because drawback claims can be filed retroactively for up to five years, consistent import-export behavior could unlock six or seven figures in refunds from past shipments alone.

The Process: What It Takes to File

Duty Drawback involves a structured process with US Customs and Border Protection (CBP). The first step requires filing an application for drawback privileges, which typically takes anywhere from four to twelve months for CBP to approve. This application establishes your company’s eligibility and outlines the specific drawback program you intend to use.

While awaiting privileges, the real work begins: data collection and matching. Successful drawback requires precise matching of import records with corresponding export records at the item level. This means correlating specific products imported on one date with the same products exported on another date.

The documentation requirements include commercial invoices, Bills of Lading, import records (CBP Form 7501), export records, and detailed product specifications. The matching process must demonstrate that exported goods are substantially the same as imported goods.

Claims are filed periodically with CBP, typically monthly or quarterly depending on export volume. The first claim typically undergoes a CBP “Full Desk Review” audit, which can involve additional documentation requests and audits. The review process ensures compliance but also means that claims must be meticulously prepared and well-documented. All supporting documentation and records must be maintained for at least five years.

Timeline expectations are important. From the initial privileges application to the first claim payment, the process typically spans six to 18 months. However, once established, ongoing claims can be processed more efficiently. With accelerated payment privileges, claims are typically paid out within 3-6 weeks of the claim being processed.

Common Myths & Realities about Duty Drawback

Several misconceptions prevent ecommerce brands from pursuing Duty Drawback, despite its clear financial benefits.

Myth: “It’s too complicated to implement.”

→ Reality: While Duty Drawback involves detailed documentation and regulatory compliance, specialized providers can manage most of the administrative burden. The complexity lies primarily in data management and regulatory filing—areas where expertise and technology can streamline the process significantly.

Myth: “My company isn’t big enough or doesn’t export enough to benefit.”

→ Reality: Duty Drawback isn’t reserved for large corporations. Mid-size ecommerce brands often see the most significant relative benefits because duty recovery can represent a meaningful percentage of their total import costs. Even modest export volumes can generate substantial recoveries when tariff rates are high.

Myth: “The process takes too long to be worthwhile.”

→ Reality: While initial setup requires patience, the retroactive nature of claims means brands can recover duties paid over several years once the program is established. The long-term financial benefits far outweigh the initial time investment.

Myth: “Drawback is only for traditional importers and exporters.”

→ Reality: Ecommerce brands are ideal candidates for Duty Drawback. Their detailed transaction records, combined with cross-border shipping patterns, often provide the exact documentation needed for successful claims.

Why Most Ecommerce Brands Aren’t Using Drawback, and Why They Should

The primary barrier to Duty Drawback adoption among ecommerce brands is simply awareness. Most merchants focus on forward-looking strategies: new markets, product development, marketing optimization, rather than backward-looking opportunities like duty recovery.

Data management concerns also deter many brands. The perception that drawback requires perfect historical records creates a mental barrier. In reality, experienced providers can work with typical ecommerce data sources and often help reconstruct missing documentation.

Administrative burden represents another deterrent. Merchants already stretched thin with core business operations worry about adding complex regulatory compliance to their responsibilities. This concern is valid but misplaced – the right drawback partner handles the administrative heavy lifting.

Some brands underestimate their export activity. Merchants shipping to Canada, Mexico, or other international markets from US inventory often don’t realize these shipments qualify for drawback. Even returns to international customers can qualify under certain circumstances.

The benefits of Duty Drawback significantly outweigh the perceived obstacles. Cash flow improvements from duty recovery can fund growth initiatives, improve competitive positioning, or simply boost profitability. In today’s challenging tariff environment, leaving this money on the table becomes increasingly difficult to justify.

Strategic Integration of Drawback into U.S. Import Models

Duty Drawback fits naturally into several US market entry strategies that international brands employ. The In-Country Enablement model benefits particularly well from drawback programs. Brands using this approach typically import goods in bulk to US 3PLs or fulfillment centers before fulfilling both domestic and international orders. The international shipments from US inventory create natural drawback opportunities.

Critically, duty drawback isn’t limited to consumer orders – it also applies when inventory is moved to support in-country enablement strategies overseas. If your company transfers inventory from the U.S. to fulfillment centers abroad (for example, to Canada, the EU, UK, or Australia), those outbound shipments may qualify for drawback as long as the inventory was previously imported into the U.S. and exported in the same condition. This means your investment in international expansion could also unlock valuable refund opportunities on duties you’ve already paid. Expanding globally can not only optimize delivery times and reduce cross-border friction, but also unlock meaningful refunds on duties and fees paid at the time of U.S. import.

Getting Started: Implementing an Effective Drawback Program

The first step in evaluating Duty Drawback potential is a simple assessment of your current drawback potential. Even if export volumes seem modest, remember that high-duty products can generate substantial recoveries on relatively small shipments. If your drawback provider is a Licensed Customs Broker, you can give them access to your import data through CBP’s Automated Commercial Environment (ACE) so that they can estimate your drawback opportunity. If you want take a shot on your own, here’s a simple Duty Drawback opportunity estimator you can run:

1. Total U.S. Duties Paid (Last 12–24 Months)

Estimate based on customs entries or import broker data

$__________

2. Percent of Goods Re-Exported

As a percentage of U.S. imports that are later exported unchanged

______%

3. Drawback-Eligible Duties and Fees

Exclude any non-recoverable amounts like the 20% fentanyl tariff

$__________

4. Estimated Refundable Amount (Eligible x Export %) x 0.99

= $__________

Finding the Right Drawback Partner

Until recently, Duty Drawback was a very specialized niche market that only a handful of providers serviced. When the Sec. 301 tariffs were implemented in 2018, duties on China-made goods increased significantly for U.S. manufacturers and drawback became a way to offset the impact. As such, many drawback providers were so busy servicing very large U.S. manufacturers that they would not take on ecommerce merchants, especially if the annual drawback opportunity was less than $100,000 per year. What’s more, legacy providers often kept up to 30% of the drawback recovered while forcing the merchant to do the majority of the drawback claim preparation.

These providers are being disrupted by new entrants who use powerful AI tools to expedite data matching and drive down the cost to serve. Once you’ve established that there’s enough drawback eligible to make it worth your while, you should look for providers with specific ecommerce experience who understand the unique characteristics of online retail operations. Key criteria include:

- Licensed customs broker status for end-to-end service

- Technology platforms that can handle ecommerce data formats

- Experience with CBP audit processes

- Transparent fee structures aligned with your business model

- Track record with mid-market brands rather than just large corporations

The ideal partner manages the entire process from Duty Drawback privileges application through claim filing and CBP audit defense, minimizing your administrative burden while maximizing recovery potential.

Data Matching: The Heart of Successful Drawback

The success of any Duty Drawback program depends on precise data matching between imports and exports. This requires connecting specific products imported on certain dates with the same products exported later – a challenge that has traditionally required extensive manual work.

Modern approaches leverage technology to automate much of this matching process. Advanced systems can parse ecommerce data, identify matching products across import and export records, and build claims automatically. This technological approach reduces both the time required and the potential for human error.

For ecommerce brands, data matching benefits from the detailed transaction records that online commerce naturally generates. Order management systems, inventory tracking, and shipping records provide the granular data needed for successful matching.

The matching process must account for the “substantially same condition” requirement. This means tracking products from import through storage to export, ensuring that items haven’t been significantly altered or processed. For most ecommerce merchandise, this requirement is easily met.

The Competitive Advantage of Duty Recovery

Duty Drawback isn’t just a tactical tool for reclaiming sunk costs—it’s a strategic pillar of long-term tariff management. As trade policies evolve, tariffs rise, and international competition intensifies, drawback provides brands with a flexible, revenue-positive way to adapt without overhauling operations or sacrificing customer experience.

And unlike other tariff mitigation strategies—like relocating suppliers or restructuring product classification—drawback doesn’t require changes to your fulfillment model, tech stack, or customer promise. It’s a low-friction, high-impact strategy that can be implemented in parallel with your existing operations.

Finally, there’s the competitive edge. Brands leveraging drawback effectively can afford to price more aggressively in international markets, knowing a portion of their landed costs will be recovered. That margin flexibility can make the difference in acquisition cost battles, tender negotiations, or D2C price wars—especially when competing against brands without a drawback program in place.

In a trade environment defined by uncertainty, Duty Drawback provides rare clarity: a dollar-for-dollar path to reclaiming costs, increasing cash flow, and future-proofing your tariff strategy.

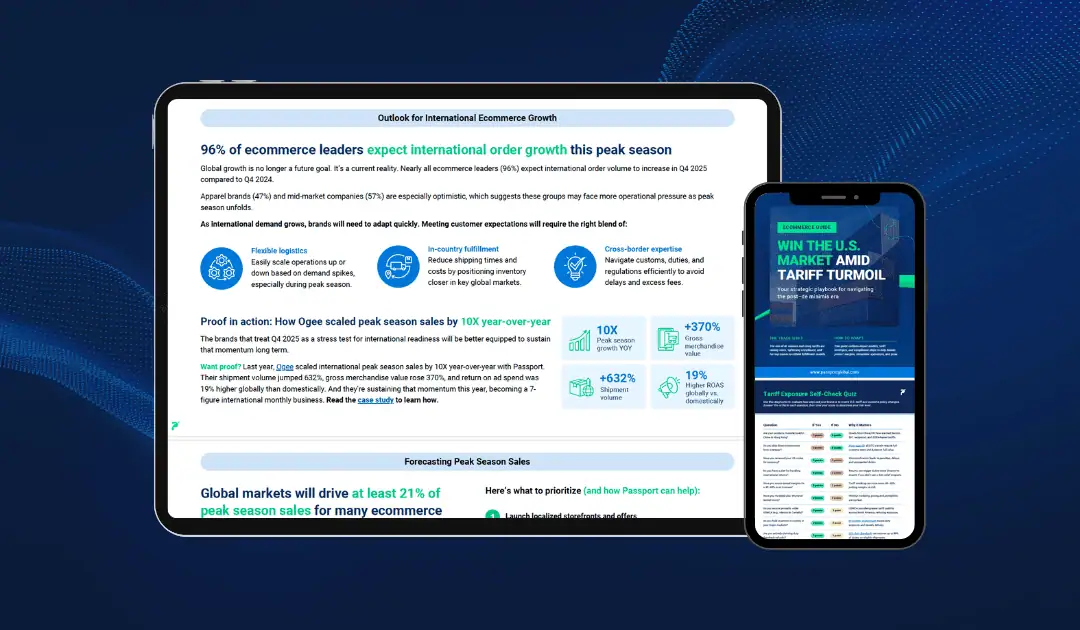

How Passport Supports Ecommerce Brands

Most ecommerce brands eligible for Duty Drawback never claim it. In fact, it’s estimated that anywhere from $3B to $13B goes unrecovered every year. That’s largely because the process is complex, documentation-heavy, and built for legacy manufacturers – not modern consumer brands moving fast and fulfilling globally. However, Passport was designed to close that gap.

As a licensed U.S. Customs Broker, Passport offers a full-service Duty Drawback solution tailored for ecommerce merchants that import finished goods into the U.S. and later export them, unchanged, to international consumers or overseas warehouses. These unused merchandise drawback claims are the most accessible, most valuable, and most overlooked type of drawback today. Here’s what Passport Duty Drawback provides:

End-to-End Management: Passport manages the entire process, from eligibility assessment and CBP privileges application to claim preparation, submission, and audit defense. We coordinate directly with your customs brokers, 3PLs, and forwarders to gather the necessary documents and match them to your export data at the SKU level. If your inventory leaves the U.S. in the same condition it arrived in, Passport can help recover up to 99% of the duties and fees you paid.

AI-Powered Data Matching: Traditional providers struggle to support ecommerce brands that may have tens of thousands of unique products and hundreds of lines per customs entry. Passport leverages technical infrastructure and AI automation to clean and match import/export records, reducing errors and unlocking refunds that would otherwise be left behind.

Integrated Logistics & Compliance: Because we manage international shipping for our merchants, we already have complete visibility into the outbound flows. This lets us map U.S. bulk imports to the individual exports to foreign consumers without relying on third-party data handoffs, significantly reducing administrative burden and improving audit readiness.

Scalable, Transparent, and Performance-Based: Since Passport only offers duty drawback as a value-added service for our merchants, we keep the costs low. There are no upfront fees and the drawback commission is well below the industry-standard 30%. Passport maintains control of the records, files with confidence, and only gets paid when refunds are recovered. The result is a low-risk, high-impact way for brands to turn past duties into new cash flow.

Building Resilience Through Smart Trade Strategy

The current trade environment rewards strategic thinking over tactical responses. Duty Drawback exemplifies this principle – it’s a long-term strategy that provides ongoing benefits rather than a one-time cost reduction.

Successful ecommerce brands in the current environment share common characteristics: they’ve built flexible supply chains, diversified their market approaches, and implemented comprehensive trade strategies that account for ongoing policy volatility. Duty Drawback fits naturally into this strategic framework.

The brands that thrive in coming years will be those that view trade challenges as opportunities to build competitive advantages. Duty Drawback transforms tariff costs from a pure expense into a potential source of recovery and competitive differentiation.

The program also provides valuable data insights. The process of tracking imports and exports for drawback purposes creates visibility into cross-border patterns that can inform broader strategic decisions about inventory placement, market prioritization, and supply chain optimization.

The question isn’t whether trade policy will continue evolving – it will. The question is whether your brand will be prepared to benefit from the opportunities that evolution creates. Duty Drawback represents one of the most accessible and impactful tools for building that preparation.

Want to explore how your brand could take advantage of Duty Drawback? Reach out to our team to learn more.

This article is provided for informational purposes only and does not constitute legal advice. Merchants are advised to consult with their customs broker and legal counsel to ensure compliance with all applicable laws and regulations based on their specific circumstances.

Authored by Thomas Taggart

Head of Global Trade | Passport

Thomas Taggart is a cross-border commerce leader with more than 20 years of experience in international shipping and regulatory affairs. As the Head of Global Trade, Thomas helps ecommerce brands go global by simplifying international trade, tax, and product compliance issues. Prior to Passport, he brought international shipping solutions to market through multiple roles in UPS’s product development organization.