The latest round of tariff enforcement has officially arrived—and for ecommerce brands sourcing from or shipping through China and Hong Kong, the disruption is already in full effect.

As of May 2, 2025, the U.S. has eliminated the $800 de minimis exemption for Chinese and Hong Kong origin goods. This means all shipments from those markets—regardless of value—now face formal entry requirements and stacked tariffs that could exceed 70% in landed cost.

Want expert insight on what this means for your brand?

Watch our latest webinar replay with Passport’s Head of Global Trade, Thomas Taggart, and international trade & tariff expert Agustin Farias, who break down the evolving landscape and offer practical, proven alternatives for maintaining U.S. market access.

[Watch the Webinar Replay]

What’s Changing—and Why It Matters

A Brief History of De Minimis

- Created in 1938, the de minimis rule initially exempted imports under $1 from duties.

- In 2016, it was raised to $800, opening the floodgates for cross-border ecommerce—especially for platforms like Shein, Temu, and Alibaba.

- In 2024, over 1.4 billion packages entered the U.S. duty-free via this rule—75%+ from China/Hong Kong.

Now in 2025…

- May 2: The U.S. formally ended de minimis eligibility for China and Hong Kong.

- May 15: China’s reciprocal tariffs were temporarily reduced to 10% (from 125%)—but only for 90 days.

- Postal shipments from China/HK now face: 54% duty or $100 per item (whichever is higher)

- More than 100K shipments have already been rejected due to de minimis violations.

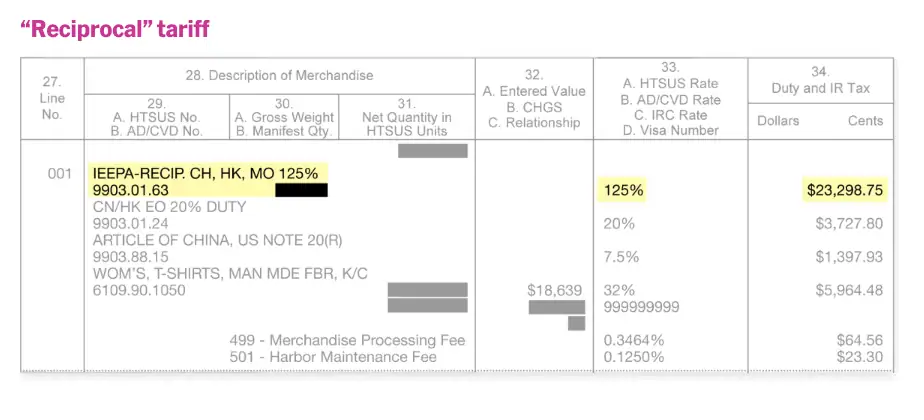

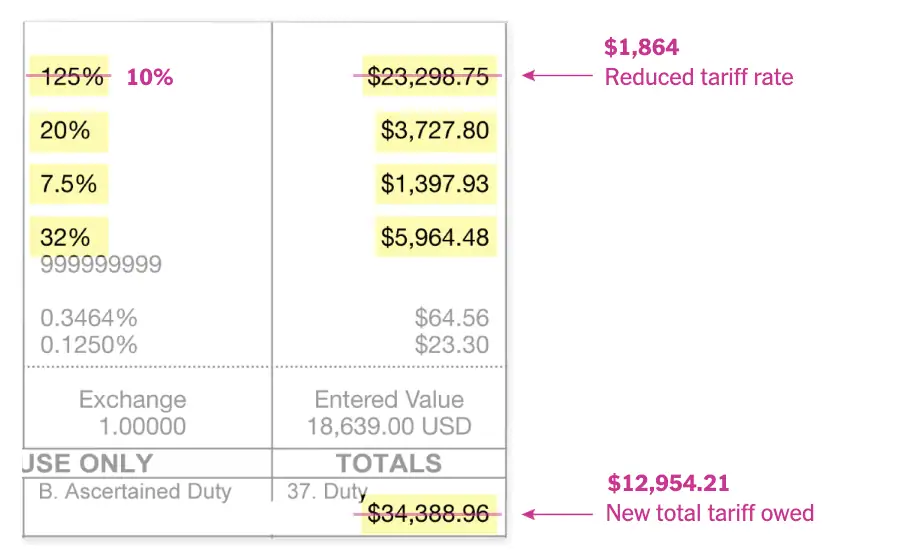

Tariffs Are Stacking: A T-Shirt Case Study

For goods like apparel, total landed costs now include:

- 10% reciprocal tariff (temporary pause)

- 20% Fentanyl Emergency Act tariff

- 25% Section 301 tariff

- Standard duty rate (e.g., 16.5% for shirts)

Result: A shipment valued at $18,700 could now incur $13,000+ in duties.

Two Proven Models to Offset the Cost

1. In-Country Fulfillment (ICF)

What it is: Forward-deploying unsold inventory to a U.S.-based 3PL before the sale.

Why it works:

- Lower declared value based on manufacturing cost

- Faster shipping + better CX

- Domestic returns + local marketplace eligibility

- Passport acts as Importer of Record and manages duties, VAT, and local compliance end-to-end

“This is the most tested and compliant model available today.” – Thomas Taggart

2. B2B2C or Intercompany Transfer Models

What it is: Establishing a U.S. subsidiary to import and sell goods at a reduced transfer price.

Why it’s risky:

- Complex customs compliance requirements

- Needs U.S. employees, independent ops, and legit transfer pricing

- Margin repatriation to the parent company is heavily restricted

- High audit risk + potential civil or criminal penalties if misused

“It’s not as simple as opening a Wyoming LLC and calling it a day.” – Thomas Taggart

Key Takeaways for UK and Global Brands

- Don’t bank on de minimis coming back—full removal for all countries is likely by end of 2025.

- The U.S. is enforcing customs law more aggressively than ever.

- If you’re sourcing from China or using cross-border fulfillment, now is the time to pivot.

- In-country enablement is more accessible, compliant, and scalable than B2B2C workarounds for most brands.

Ready to Adjust Your Strategy?

At Passport, we help ecommerce brands adapt to trade policy shifts with:

- End-to-end in-country enablement

- Seller of Record® tax compliance

- Smart duty + tariff mitigation strategies

- Trade consulting and documentation support

At Passport, we’re dedicated to helping you navigate these complex compliance changes with confidence. Whether you need to optimize your pricing strategy, consolidate orders, or localize your fulfillment operations, we have the tools and expertise to support your growth.

Explore our full suite of services or book a demo with our team to discuss your options.

And for the latest insights and updates, visit TrumpTradeTracker.com.

*This article is provided for informational purposes only and does not constitute legal advice. Merchants are advised to consult with their customs broker and legal counsel to ensure compliance with all applicable laws and regulations based on their specific circumstances.