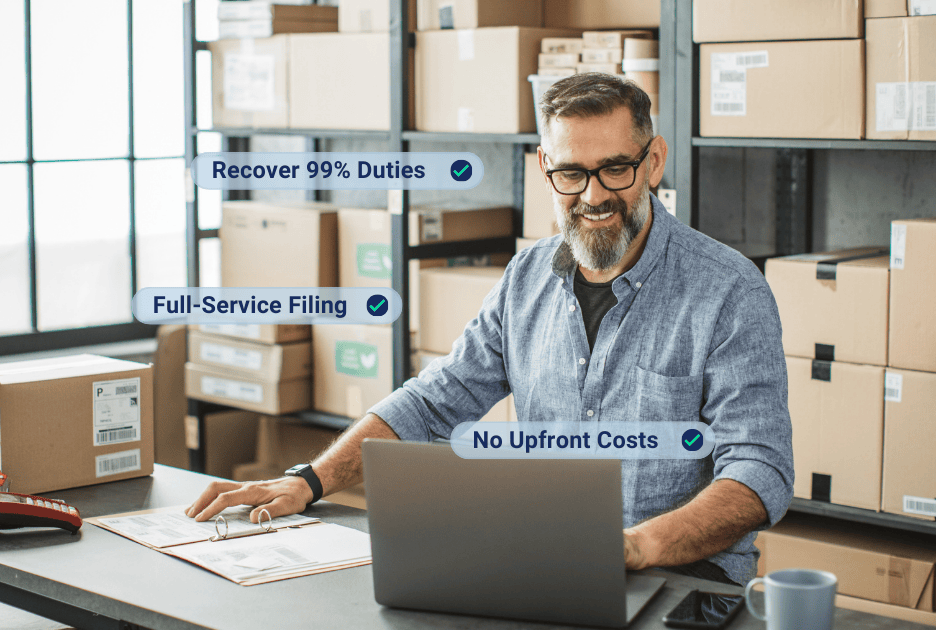

Get refunds on duties you’ve already paid.

Unlock up to 99% back on qualifying international shipments with Passport’s full-service duty drawback solution.

Get turnkey, end-to-end support when you choose Passport Global.

Turn sunk costs into cash flow

The global trade landscape has changed. Tariffs are rising, costs are up, and compliance is more complex than ever. But many brands don’t realize they could be owed thousands—even millions—in refunds. If you’ve paid duties on goods imported into the U.S., and later exported, returned, or destroyed those goods, you may be eligible to recover up to 99% of what you paid. Passport helps make it simple.

Licensed Brokers, Not Consultants

We’re one of the few ecommerce-first providers licensed to file directly with CBP. That means faster results, fewer errors, and full compliance.

Ecommerce-First Technology

We integrate with common ecommerce platforms and help consolidate fragmented data from 3PLs, ERPs, and sales channels to build complete claims. And as your international parcel carrier, we already have half of the equation–your export data.

Hands-On Support

We guide you every step of the way, from eligibility checks to audit readiness. And we proactively look for opportunities you may not know exist.

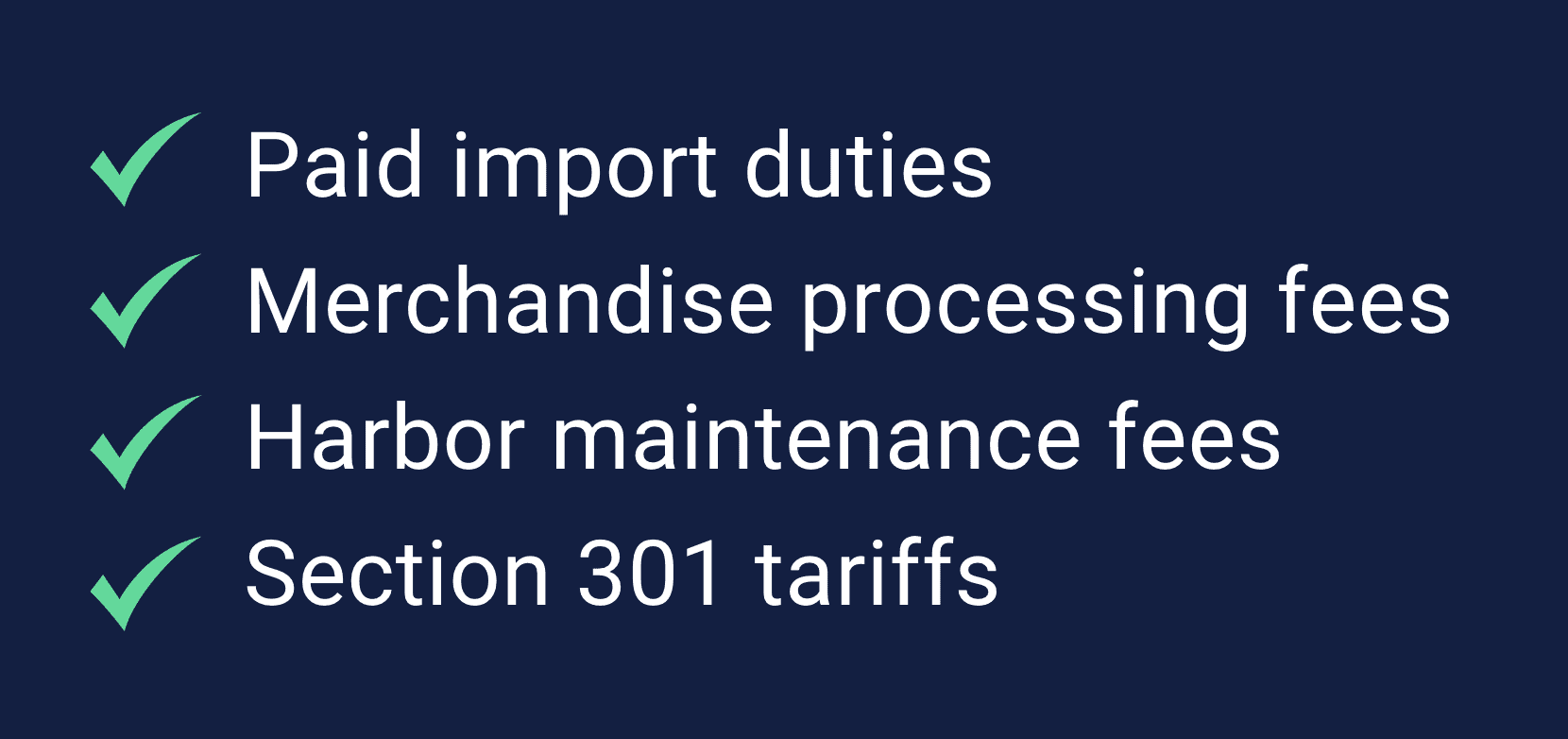

Recover Duties & Fees

Our licensed customs brokers file directly with U.S. Customs and Border Protection (CBP), helping your brand recover paid duties, merchandise processing fees, harbor maintenance fees, and Section 301 tariffs. With three types of drawback available (unused, manufacturing, and returned/destroyed), Passport helps determine your eligibility and does the heavy lifting.

End-to-End Service,

No Upfront Fees

Our ecommerce-focused drawback program is built for modern brands. We handle the end-to-end claim process, including:

- Import/export record review and claim estimation

- CBP documentation and submission

- Filing and audit support

- Claim tracking and recovery

Best of all, our duty drawback service is entirely contingency-based—there are no upfront costs and no charges until your refund is successfully recovered. Our service fee comes directly from the drawback proceeds, so you never pay out of pocket. If you don’t get paid, we don’t get paid.

Retroactive Recovery for Up to 5 Years

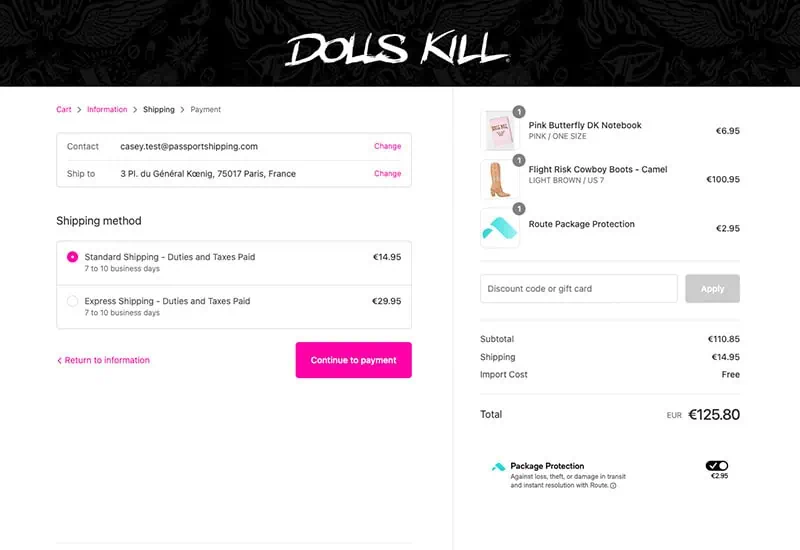

Think you missed your chance? Think again. U.S. law allows drawback claims up to five years from the date the designated merchandise is imported. That means you may be eligible to recover duty costs going back multiple fiscal years. Brands like Dolls Kill are already unlocking new cash flow from past shipments—and putting it back into growth.

“Over the past two years, Passport has helped us recover huge savings through Duty Drawback. Not only that, they significantly improved our cash flow through a unique drawback solution so we didn’t have to wait a year to receive our claim.”

– Austin Jang, VP of Operations

You’re one call away from reclaiming your refunds

Let us help you turn past duty payments into future growth. With Passport, duty drawback is simple, compliant, and tailored for ecommerce brands.

FAQs

What is duty drawback?

Duty drawback is a U.S. Customs program that refunds up to 99% of duties, tariffs, and fees paid on imported goods that are later exported, returned, or destroyed. It’s been around since 1789, but most eligible businesses never file.

Who is eligible for duty drawback?

You may qualify if you’ve paid U.S. duties and later shipped those goods to international customers, transferred them to an overseas warehouse, used imported components to manufacture exported goods, or destroyed/returned them under customs supervision.

How far back can I file a claim?

Up to 5 years from the date of import—meaning you could recover duties from multiple past fiscal years.

What does it cost to work with Passport?

Nothing upfront. Our service is entirely contingency-based, with the fee deducted from your refund once it’s recovered. If you don’t get paid, we don’t get paid.

Where can I find the latest tariff updates?

Visit TrumpTradeTracker.com for up-to-date tariff changes, timelines, and trade strategy resources. You can also find expert content about duty drawbacks and other compliance topics in our blog, https://passportglobal.com/news-and-articles/.

Latest News and Articles

Top Global Expansion Ecommerce Markets: Where U.S.-Based Brands Are Growing Next

An overview of the leading international ecommerce markets for U.S. brands, covering growth trends, tax frameworks, tariff updates, and operational considerations by region.

Trump Tariff Talk 2026: Navigating the Greenland Reversal, IEEPA Ruling, and New EU Handling Fees

Navigate the 2026 trade whiplash: Expert insights on the Greenland tariff reversal, IEEPA refund strategy, and new EU handling fees for e-commerce.

EU & UK Customs Developments: An Ongoing Guide for Ecommerce Imports

EU and UK plans to phase out duty de minimis could reshape low-value imports. Learn what’s changing and the measures Passport has in place to keep operations steady.

IEEPA Tariffs & the Supreme Court: An Ongoing Guide for Importers

Learn what the Supreme Court’s IEEPA tariff decision could mean for importers, including duty impact, refund questions, and next steps.