Expanding internationally can be transformational for ecommerce brands, introducing new revenue streams and a larger customer base. With online shopping now ingrained in everyday life and consumer demand continuing to rise worldwide, those not selling across borders are leaving revenue on the table. Shopify projects that global ecommerce sales will reach $6.56 trillion in 2025 and climb to $8.09 trillion by 2027 – a clear sign that international markets offer major opportunities for growth.

While the potential to scale is substantial, the reality of going global isn’t always easy. Entering new markets comes with layers of financial and regulatory complexity, from managing duties and taxes to navigating country-specific requirements. It’s a major operational challenge; in fact, 74% of U.S. business leaders say regulatory compliance is one of the biggest hurdles to international growth.

At Passport, we’ve helped thousands of brands overcome these obstacles as they’ve expanded and shipped to new markets around the world. Traditionally, companies have relied on a Merchant of Record for cross-border tax compliance, but these models often come with trade-offs such as delayed cash flow, limited pricing flexibility, and reduced control over your own storefront.

Recognizing the need for a more adaptable solution, we designed Seller of Record – a more flexible alternative that provides the same level of tax compliance while allowing brands to maintain direct cashflow and full control over their store, business, and data.

Increasing Tax Complexities in International Ecommerce

Over the last decade, cross-border tax compliance has become increasingly complex for ecommerce brands. Today, more than 160 countries worldwide impose VAT (value-added tax) or GST (goods and services tax) on imported products. Typically, these taxes are collected at the point of sale from the end customer and then remitted to the government by the business.

International tax payments are generally handled in two ways:

1. Paid during import clearance – In most markets, the shipping carrier or customs broker manages taxes during the import clearance process, relieving merchants of direct involvement.

2. Paid through tax returns – Certain countries require foreign merchants to register locally, collect taxes at checkout, and remit them directly to government authorities. This process can be administratively complex and costly for businesses.

Increasingly, countries are shifting tax responsibilities directly to merchants, requiring companies to register locally and collect taxes at checkout once they surpass specific sales thresholds.

For US-based ecommerce brands, this change introduces new operational hurdles, turning global selling into a complex process that may now include obligations such as:

- Registering for local tax IDs in multiple markets

- Collecting and remitting taxes based on country-specific rules

- Submitting tax filings and responding to inquiries from foreign government authorities

This new landscape has made expanding into new markets more challenging for ecommerce brands. Below is a breakdown of countries that require tax registration, along with their specific regulations.

Global Markets Requiring Tax Registration & Compliance Rules

(21% Avg.)

2.6% Reduced VAT

(for food, supplements, books)

+ $1M SGD in sales globally

When Are Tax Compliance Solutions Actually Needed?

A common misconception in global ecommerce is that a tax compliance solution (whether Merchant of Record or Seller of Record) is necessary in every market. In reality, these solutions are only needed for the countries listed above. In most other regions, taxes are simply paid upon import, with no tax registration required.

This assumption often leads to unnecessary costs, but with Seller of Record, you only pay for tax compliance where it’s truly needed.

Seller of Record: Solving for Cross-Border Tax Compliance

Passport Seller of Record® (patent pending as of February 2025) launched in 2021 to simplify cross-border tax compliance for ecommerce brands by managing tasks such as collecting, reconciling, and remitting VAT and GST.

Seller of Record: A legal construct that designates an entity as the official seller of goods at the time of purchase, making it responsible for indirect tax compliance.

While not all international markets require local tax registration, Seller of Record covers those that do, automatically handling fiscal obligations once specific sales thresholds are met. Having this solution in place ensures you’re compliant wherever you sell, protecting your brand from potential risks like fines, penalties, and shipment delays.

Why Passport Created Seller of Record

Traditional Merchant of Record models were designed decades ago to address the challenges of early online commerce, when securing a payment gateway and processing credit card transactions was far more complex. At the time, they played a critical role in facilitating payments, mitigating fraud risks, and managing international tax compliance.

However, as ecommerce has evolved, platforms like Shopify, Stripe, and PayPal now provide seamless payment processing, built-in fraud protection, and secure checkout solutions – eliminating many of the obstacles Merchant of Record was created to solve. Given this shift, the traditional trade-offs such as delayed cash flow, reduced pricing flexibility, and less control over the customer experience now often outweigh its original advantages.

At Passport, we saw firsthand how these compromises impacted brands expanding into new markets. Recognizing the need for a more flexible solution, we launched Seller of Record. Our goal was to empower ecommerce merchants by simplifying cross-border tax compliance while still allowing them to retain full control over their cash flow, store, and customer relationships.

Top 6 Benefits of Seller of Record

1. Direct Cash Flow

Receive payments directly from customers, eliminating intermediary delays for quicker cash flow.

2. No Tax ID Registration Needed

With Seller of Record, you use Passport’s tax IDs instead of your own. No need to register for tax IDs in applicable countries.

3. Save Time, Skip the Tax Tasks

Passport takes care of everything from tax collection, to reporting, and remittance, covering all your compliance needs.

4. Only Pay Taxes When Required

Passport actively tracks country-specific sales thresholds, so you only pay taxes when necessary.

5. Stay in Control of Your Store

Keep complete control over your store, data, and customer experience, with expert support whenever you need it.

6. Quicker Customs Clearance

Using Passport’s tax IDs streamlines customs clearance and minimizes shipment delays.

Proven Success with Seller of Record

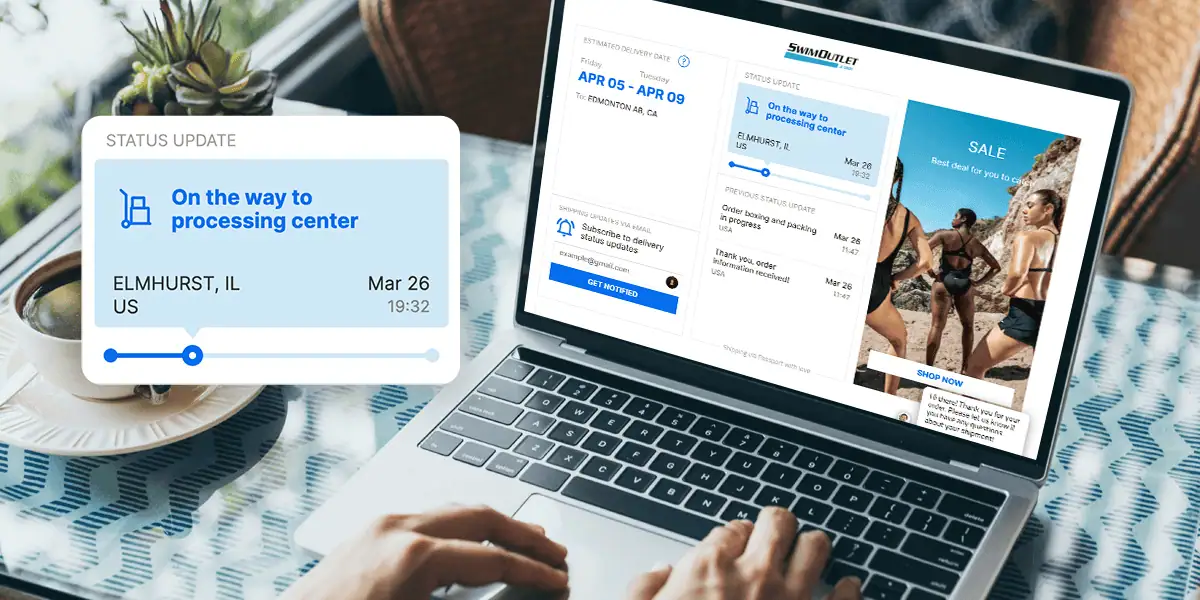

Spiraledge Saved $79,500 in Compliance Costs

With Passport’s Seller of Record model, Spiraledge avoided over $79,500 in fiscal compliance expenses including registration fees and ongoing annual expenses in countries requiring local tax registration. This allowed them to reinvest savings into growth initiatives instead of tax compliance efforts.

Read the full success story on how Spiraledge brands (SwimOutlet & Everyday Yoga) increased their international sales by $3.2M

Carpe Expanded into 36+ Markets,

Doubling their International Revenue Contribution from 5% to 10%

Before Passport, Carpe’s shipments were frequently held at customs due to duties and taxes, leading to frustrated customers and delayed deliveries. By utilizing Seller of Record, Carpe was able to enter new markets within days – without the hassle of tax registration. This allowed them to test demand, scale efficiently, and maintain control over their global sales strategy, ultimately doubling their international revenue contribution from 5% to 10% of total revenue.

Read Carpe’s full success story here

How Passport Seller of Record® Works:

1. Enrollment – Your brand enrolls in Seller of Record once it surpasses a market’s sales threshold. Passport tracks these thresholds and notifies you when registration is required.

2. Customer Purchase – When customers shop on your website, your brand collects payments for the products along with any duties, taxes, and shipping fees at checkout. Passport offers landed-cost solutions to display accurate duty and tax calculations real-time in cart.

3. Official Seller Designation – Passport purchases the items from your brand through a “flash sale” or subsale, officially becoming the legal seller.

4. Customs Clearance – Passport’s tax ID is used to clear shipments through customs in the destination country and is listed as the seller on customs documentation.

5. Tax Management – Passport handles tax filings with local authorities and works directly with tax offices to address any inquiries or issues.

6. Invoicing – Passport invoices your brand for taxes paid, plus a nominal program fee if applicable*.

* Pricing Details: Passport Global customers enjoy Seller of Record as part of our full suite of compliance services at no additional cost. For Passport Shipping customers, the Seller of Record fee is 5% of the GST amount, calculated based on the CIF value (product price + shipping + shipment protection).

What markets is Seller of Record available in?

Passport offers a Seller of Record solution in all markets where direct-to-consumer brands are required to register for a local tax ID, including:

- European Union (EU)

- United Kingdom (UK)

- Australia (AU)

- New Zealand (NZ)

- Norway (NO)

- Singapore (SG)

- Switzerland (CH)

* Click on each market to learn more about how taxes apply in each of these regions.

Comparing Compliance Models: Seller of Record vs. Merchant of Record

Both Merchant of Record and Seller of Record provide the same level of tax compliance coverage, but the differences between them can have a significant impact on cash flow, profitability, and customer experience.

Merchant of Record: The entity legally recognized as the seller in a transaction, responsible for payment processing, tax compliance, and financial obligations.

With a Merchant of Record model, the provider takes responsibility for the entire ecommerce transaction, managing both payment processing and tax compliance. Whereas the Seller of Record model focuses solely on tax compliance, allowing brands to retain control of payments and their store data – a major advantage for growing brands.

To better understand the distinction between the two, let’s break down the key aspects and why they matter for ecommerce brands.

Cross-Border Tax Compliance Model Comparison

Choosing the Right Tax Compliance Model

Overall, Seller of Record provides a more flexible approach to international tax compliance, striking the perfect balance between adaptability and regulatory requirements. It allows brands to maintain control over core aspects of their business while staying compliant in global markets.

For most direct-to-consumer brands, Seller of Record is the ideal model for simplifying cross-border selling. However, in certain situations that require local banking – such as selling on marketplaces or fulfilling orders within a country – a Merchant of Record is necessary. Passport, through its Passport Global all-in-one solution, offers options for both scenarios, allowing brands to implement the right compliance approach based on their specific market needs.

[For a deeper dive into Seller of Record vs. Merchant of Record, check out this article]

The Future of Global Ecommerce & How to Stay Ahead

Ecommerce isn’t slowing down – global sales are rising, presenting fresh opportunities for brands looking to grow. But with expansion comes complexity. More countries are tightening regulations, requiring brands to register, collect taxes at checkout, and navigate an increasingly intricate trade landscape, making it harder than ever to enter new markets.

It’s not just about following the rules; it’s about doing so without adding unnecessary friction to operations. Traditional tax compliance models can slow things down, introducing hurdles that impact cash flow, profitability, and customer experience. To keep up, brands need solutions that go beyond compliance and actively support their growth.

At Passport, we’re committed to making international selling easier and helping brands reach their full global potential. That’s why we created Seller of Record – so you can can focus on what you do best while a trusted partner handles the heavy-lifting of cross-border tax compliance. As international ecommerce continues to evolve, the brands that remain agile – embracing efficient, scalable solutions – will be best positioned to thrive in an increasingly global marketplace.

Ready to reach your global potential?

Request a demo with the Passport team today to explore how Seller of Record can help you scale seamlessly.

Authored by Thomas Taggart

Head of Global Trade | Passport

Thomas Taggart is a cross-border commerce leader with more than 20 years of experience in international shipping and regulatory affairs. As the Head of Global Trade, Thomas helps ecommerce brands go global by simplifying international trade, tax, and product compliance issues. Prior to Passport, he brought international shipping solutions to market through multiple roles in UPS’s product development organization.

With expert insights from Traci Fisher

Senior Manager, Global Compliance-Ops | Passport

Traci Fisher is a seasoned Customs Compliance leader with over 17 years of experience in International Logistics and Customs. Traci earned a BS degree in International Business from Arizona State University, and as a U.S. Licensed Customs Broker since 2016 and a Certified Customs Specialist (CCS) since 2021, she brings extensive expertise in navigating complex customs regulations. Traci is dedicated to ensuring compliance, optimizing international trade processes, and supporting business growth through strategic customs solutions.

At Passport, we have a team of global trade and compliance professionals assisting in the hands-on management and support of hundreds of ecommerce brands. To learn more about Passport’s compliance services, visit https://passportglobal.com/compliance-services/.