With new tariffs taking effect and more trade action on the horizon, ecommerce brands are facing real potential risk this holiday season. In this strategic breakdown, Passport’s VP of Sales, Chris Ziomek, explores how leading brands are rethinking fulfillment to reduce costs, improve compliance, and stay profitable through peak season.

Global ecommerce continues to expand—but profitability is under pressure. With new U.S. tariffs set to take effect August 1 and more trade actions on the horizon, direct-to-consumer (DTC) brands are heading into peak season facing rising costs, stricter compliance requirements, and growing uncertainty.

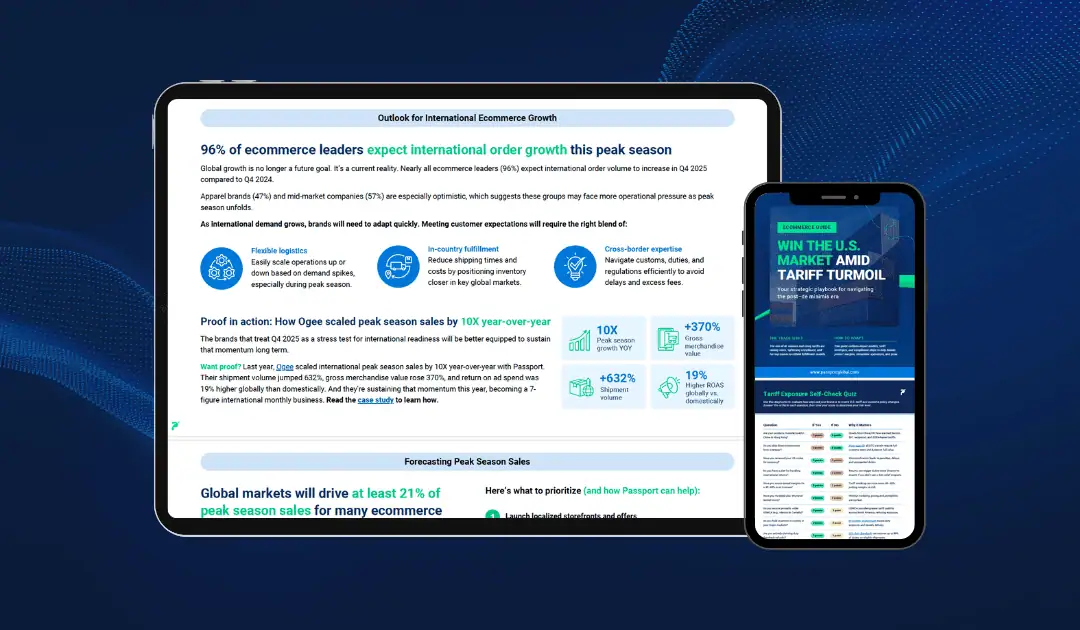

According to Passport’s 2025 survey of ecommerce leaders, 81% of respondents say tariffs are one of their biggest international challenges. More than half have already experienced increased scrutiny from trade authorities in the past year. But many have yet to adjust their logistics or compliance strategies—putting both margins and customer experience at risk during the most critical sales quarter of the year.

In fact, 7 in 8 ecommerce leaders say they’ve already raised prices (or plan to) during Q4 2025 to offset expected costs from tariffs and de minimis changes. It’s a clear signal that brands are bracing for impact. The question is: will those pricing moves be enough without operational changes behind them?

Growth alone no longer guarantees profit. Brands that treat tariffs as a secondary concern may find themselves caught off guard. Here’s what DTC teams need to know about the rising cost of inaction—and how leading ecommerce brands are preparing now to protect performance through Q4 and beyond.

Tariffs Are Reshaping Peak Season Risk

Tariff policy isn’t just shifting—it’s accelerating. Over the past several months, a series of trade developments have added real cost and compliance pressure for ecommerce brands. As we approach peak season, understanding what’s already in effect (and what’s coming next) is essential to protecting margins and customer experience.

- Flat 10% tariff on most imports (effective April 10):

A universal 10% tariff now applies to most U.S. imports, replacing country-specific rates for the time being and driving up landed costs across the board. - 30% tariff on goods from China and Hong Kong (effective April 10):

Chinese-origin products are subject to a combined 30% tariff—10% reciprocal plus 20% trade action—adding significant cost to many ecommerce supply chains. - De minimis ended for China and Hong Kong (effective May 2):

All shipments now require full customs clearance and are subject to duties, eliminating a key cost-saving mechanism and increasing documentation requirements. - Stricter customs enforcement across global markets (ongoing):

Authorities in the U.S., EU, and other key regions are stepping up audits and penalties for misclassification, undervaluation, and incomplete documentation—raising the compliance stakes.

What’s coming August 1:

- New reciprocal tariffs of up to 50%:

Without finalized trade agreements, imports from major U.S. partners—including Brazil, Canada, the EU, and others—could face steep duty increases just as peak shipping volumes ramp up.

Together, these changes are driving up costs, complicating customs flows, and increasing the risk of surprise fees or delivery delays—right when brands can least afford it.

Global Sales Remain Profitable, Even Amid Rising Complexity

Cross-border ecommerce remains a powerful growth engine. In Passport’s 2025 whitepaper, 91% of international merchants said global sales are a profitable revenue stream, with half reporting that international orders account for at least 21% of total revenue.

But as tariffs rise and trade requirements tighten, that profitability has become harder to protect. Many brands still rely on outdated cross-border models—leaving them exposed to fluctuating costs, customs disruptions, and compliance risks during the most critical sales period of the year.

How Leading Brands Are Getting Ahead of Tariffs

To stay competitive this peak season, leading DTC brands are reevaluating their fulfillment strategies and approaching global sales with a sharper operational lens. Top-performing teams aren’t just reacting to new tariffs—they’re building fulfillment infrastructure that supports profit and performance in a more complex trade environment.

1. In-country enablement for high-volume markets

Relocating inventory into key destination markets reduces tariff exposure, improves customs clearance, and opens access to domestic-only sales channels like Amazon and Walmart. It also enables faster shipping, easier returns, and tighter inventory control—key advantages during the holiday rush, when customer expectations are at their peak.

In many cases, in-country enablement has shifted from a cost-control tactic to a growth driver. Brands are using it to unlock new revenue streams, meet marketplace requirements, and deliver a better post-purchase experience.

2. Smarter cross-border strategies for emerging markets

For regions where in-country warehousing isn’t yet justified, brands are investing in tools to make cross-border shipping more predictable and cost-effective. This includes calculating landed costs more accurately at checkout, streamlining customs documentation, and collecting tax IDs in applicable markets to avoid delivery delays.

Alongside operational improvements, many brands are also revisiting pricing strategies—testing duty-inclusive pricing and experimenting with different shipping configurations to offset rising costs without hurting conversion. These trends have emerged across recent industry research and reflect how leading ecommerce teams are adapting to a more complex cross-border environment.

Rather than applying a one-size-fits-all approach, leading brands are segmenting their international strategy—localizing where the volume supports it, optimizing cross-border operations elsewhere, and adjusting pricing in response to evolving tariff and compliance pressures. This level of intentionality is what sets apart brands that grow globally and sustainably.

Protecting Peak Season Performance

Peak season is not the time to discover hidden tariff costs or compliance issues. With trade conditions changing quickly, brands that wait to adapt risk avoidable delays, margin loss, and customer frustration during their most important sales window.

Now’s the time to act. Whether through in-country fulfillment, smarter cross-border tools, or both, brands that take steps today will be better positioned to navigate uncertainty—and come out ahead this holiday season.

Authored by Chris Ziomek

SVP of Sales | Passport

Chris Ziomek, SVP of Sales at Passport, is a veteran entrepreneur and sales leader with 15 years in Tech/SaaS. Known for propelling sales growth and forging impactful partnerships across Apparel, Footwear, Automotive, and Beauty industries, Chris’s expertise extends far. A pivotal force at Dailybreak, acquired by Connelly Partners, and later leading the Strategic Accounts team at Promoboxx, Chris boasts successful collaborations with giants like General Motors, New Balance, and L’Oreal.

This article is provided for informational purposes only and does not constitute legal advice. Merchants are advised to consult with their customs broker and legal counsel to ensure compliance with all applicable laws and regulations based on their specific circumstances.