Leave the taxes to us. Keep the payments for yourself.

Passport Seller of Record® is a Merchant of Record alternative that allows you to outsource the burden of VAT/GST management to our tax experts while retaining control of your cash flow.

Get Passport Seller of Record® included when you choose Passport Global.

A smart, fast alternative to Merchant of Record

Navigating international markets presents unique fiscal compliance challenges for ecommerce brands. Traditional solutions like Merchant of Record (MOR) offer outsourced indirect tax management but not without downsides. And as platforms like Shopify provide native fraud protection functionalities, the need for an MOR to handle payment processing has diminished. That’s why Passport developed a smart, easy process that keeps you in control.

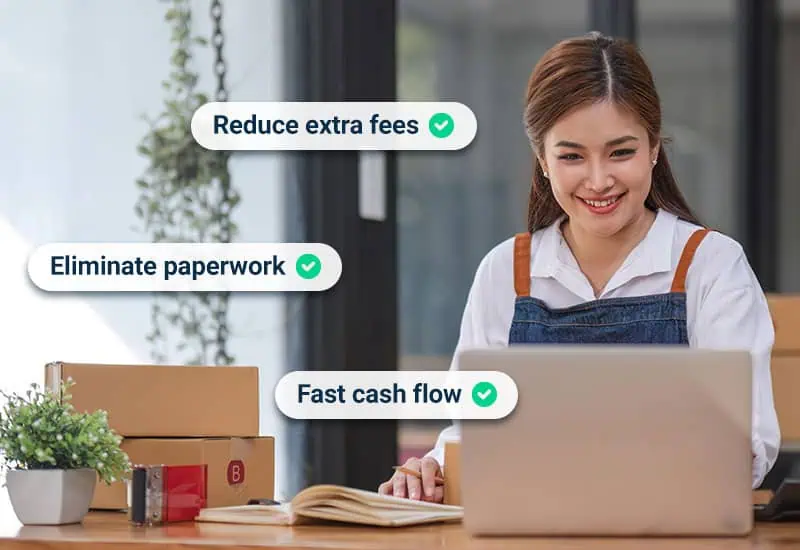

Outsource Tax Management

Simplify international tax compliance by having our customs and trade experts handle tax collection, reporting, and remittance using our tax ID in all countries that require registration. This alleviates the regulatory burden and time-consuming work for you.

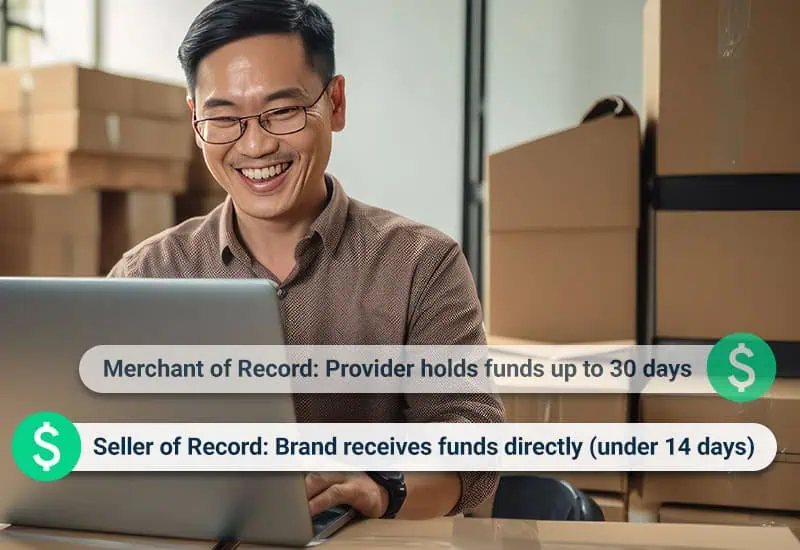

Direct Access to Cash Funds

Passport Seller of Record® (SOR) allows brands like Carpe to directly receive payments from customers, facilitating immediate access to revenue without intermediary delays. This setup ensures quicker cash flow, crucial for maintaining and scaling operations.

Pay Only Required Taxes

With SOR®, we make sure taxes apply only after surpassing sales thresholds. Our in-house customs and trade experts help you monitor these thresholds so you only pay taxes when required. This reduces extra fees and improves the customer experience, helping you boost conversion rates.

Tax Coverage for all Required Markets

Passport currently offers our SOR® program in all markets that may require merchants to collect taxes at checkout and remit them outside of the import process. These regions include: EU, UK, Australia, New Zealand, Singapore, Switzerland, and Norway. For countries not currently part of our program (such as Canada, Mexico, and India), there is no need to have a local tax ID as taxes owed are always paid through the customs clearance process.

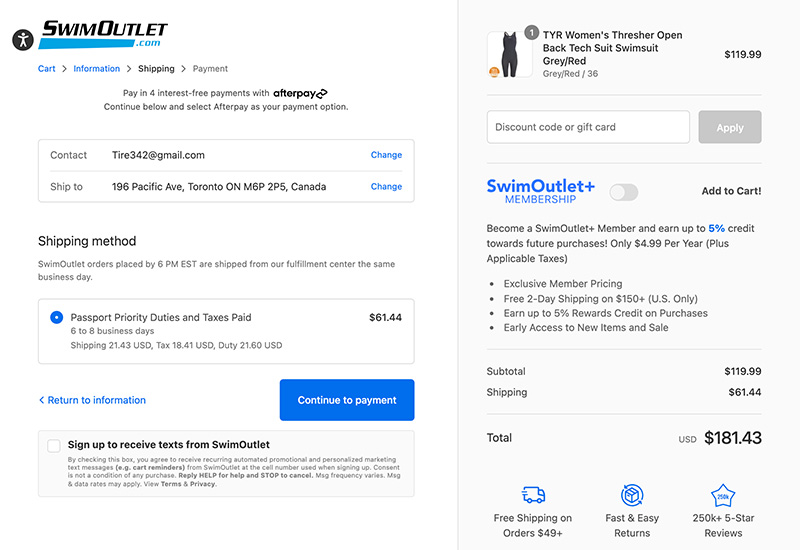

Expert Threshold Monitoring

The Passport SOR® structure applies taxes based on sales thresholds specific to each country, ensuring taxes are only paid when necessary. Passport monitors these limits on your behalf, allowing you to benefit from low-value exemptions and optimize tax payments to align with your actual sales volumes. Customers like Spiraledge have avoided tens of thousands of fiscal compliance costs, including registration fees.

Support from Industry Experts

Passport stands out by having both in-house shipping capabilities, as well as in-house licensed customs brokers. Let us address any compliance questions and resolve issues for you, reducing your administrative burden without increasing risk. Under SOR®, we clear your shipments using our tax ID in countries where VAT and GST registrations are required.

“Passport Seller of Record® has made global tax compliance something we don’t have to think about. Passport has been so proactive about reaching out as soon as we pass a threshold to make sure we stay compliant. It takes something off my plate and gives me one less thing to worry about.” — Vanessa Nguyen, Operations Manager

Global Scale, Local Simplicity

Whether you're moving into the U.S., UK, Canada, the EU, or beyond—Passport Global makes it easy to establish your local footprint and win the market.

Ready to go local? Let's talk.

Latest News and Articles

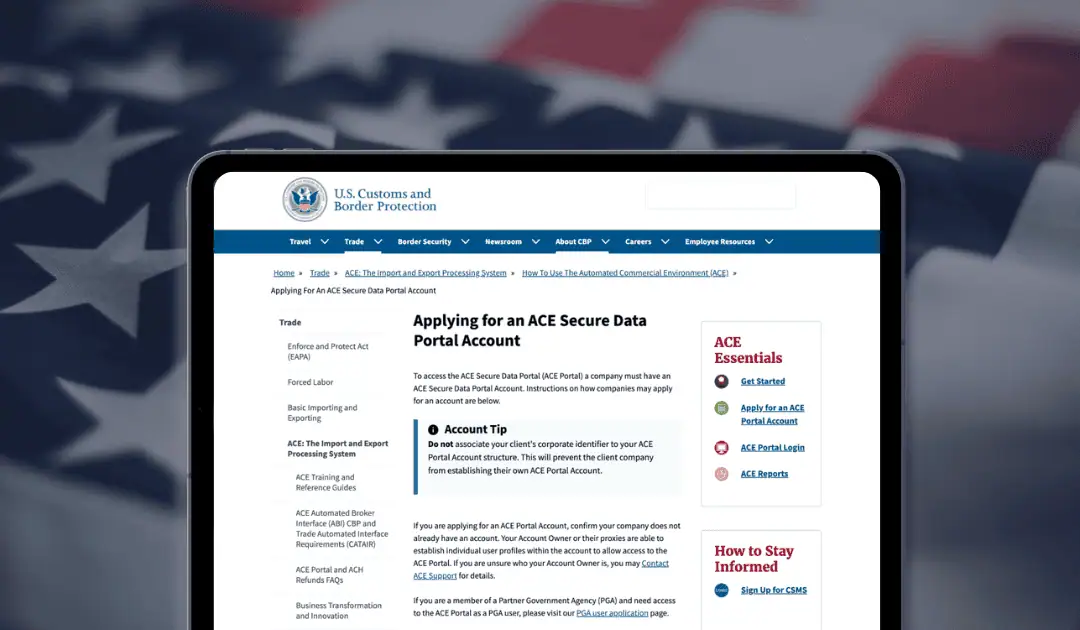

How to Get a CBP ACE Account

Step-by-step guide to getting a CBP ACE account. Learn how importers can verify eligibility, avoid signup delays, and access entry, duty, and liquidation data.

Reclaiming IEEPA Tariffs: A Practical Guide for U.S. Ecommerce Importers of Record

Learn how U.S. ecommerce importers of record can recover invalidated IEEPA tariffs. Step-by-step guidance on eligibility, deadlines, liquidation status, and filing protests or corrections.

Top Global Expansion Ecommerce Markets: Where U.S.-Based Brands Are Growing Next

An overview of the leading international ecommerce markets for U.S. brands, covering growth trends, tax frameworks, tariff updates, and operational considerations by region.

Trump Tariff Talk 2026: Navigating the Greenland Reversal, IEEPA Ruling, and New EU Handling Fees

Navigate the 2026 trade whiplash: Expert insights on the Greenland tariff reversal, IEEPA refund strategy, and new EU handling fees for e-commerce.