Global trade just got trickier—we’ll help you navigate it

As tariffs rise and de minimis fades, compliance is no longer optional—it’s essential. Passport’s trade experts help you stay ahead of shifting regulations so your brand keeps moving forward, not stuck at the border.

Looking for an all-in-one compliance and in-country solution?

Simplify compliance in a complex world

Selling internationally requires more than fast shipping—it demands precision across customs, duties, tariffs, and local regulations. Passport’s licensed brokers and trade experts help you stay compliant, reduce friction, mitigate risk, and focus on growth—not red tape. Pick the services you need, or choose Passport Global – our bundled solution featuring a full suite of compliance services designed to optimize growth.

Streamline the Complicated

From HS classification to customs valuation and clearance optimization, we help you clear customs confidently—even as regulations evolve.

Protect Your Bottom Line

Avoid costly delays and overpayment with accurate landed-cost calculations, preferential duty strategies, and automated tax management that keeps your margins strong—especially as tariffs rise.

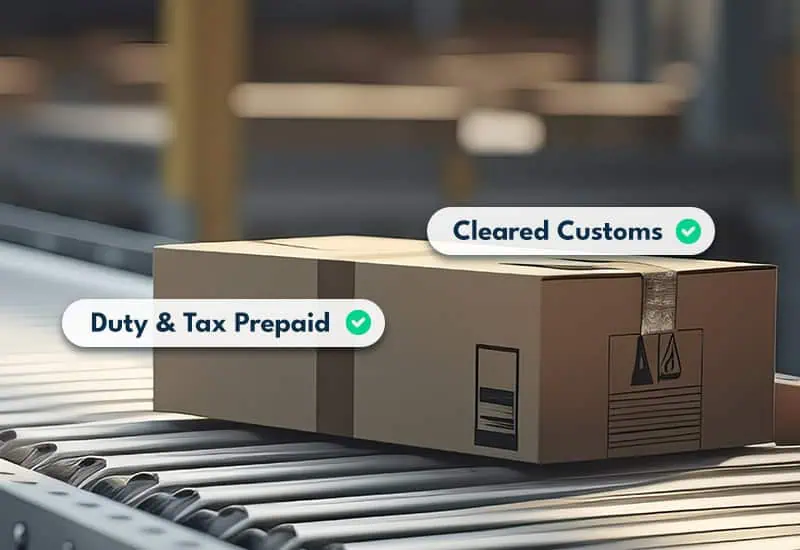

Serve Customers Better

Enhance customer experience with DDP shipping options that provide transparent pricing, seamless delivery, and proactive handling of any customs or carrier issues for a hassle-free process.

Customs & Trade Compliance

With rising trade tensions and shifting import policies, Passport helps you stay compliant at every touchpoint:

-

Product eligibility reviews

-

HS code classification

-

Customs valuation & documentation

-

Country of origin & preferential tariff assessments

-

Clearance strategy recommendations

-

Landed cost and duty impact analysis

- Duty drawback filing support

Our team stays current so you don’t have to—giving you confidence that every shipment clears customs quickly, cost-effectively, and compliantly.

For up-to-date information on tariff and de minimis changes, visit our news aggregator, TrumpTradeTracker.com.

Fiscal & Tax Compliance

Reach global consumers without establishing a local entity or hiring an expensive accounting firm through our international tax solutions. We support both Passport Seller of Record (SOR®) and Merchant of Record (MOR) models to fully manage international tax compliance based on your expansion strategy.

With SOR®, Passport collects VAT/GST at checkout and handles filings, threshold monitoring, and reporting—ideal for scaling brands. With MOR, Passport assumes legal seller status to manage compliance end-to-end, unlocking greater savings for large global brands.

In both models, brands retain full control of their storefront, checkout experience, and customer data, with added support including indirect tax consulting and duty/tax recovery.

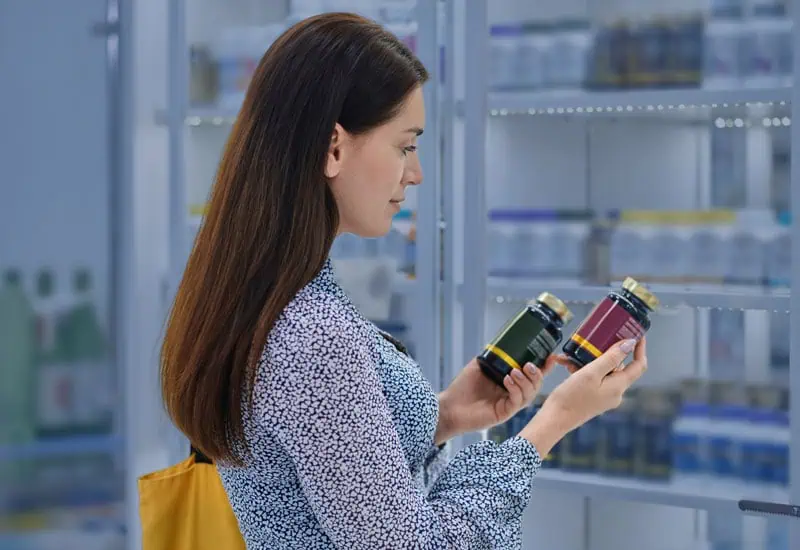

Product Compliance

Passport’s product compliance services simplify the process of shipping items internationally by managing the intricacies of health and safety regulations worldwide. We handle everything from market entry research and detailed regulatory assessments to product ingredient reviews and identifying any necessary licenses, certificates, or permits. Our tailored support not only ensures your products meet destination country standards, but also strategically leverages exemptions to optimize entry into global markets.

Navigate tariffs and local market changes with expert support

Schedule an intro call to learn more about our compliance support.

FAQs

Why is global trade compliance important?

Beyond the legal requirements, global trade compliance is crucial for a company’s success in international markets. Staying compliant can help you avoid financial penalties, foster supply chain efficiency, unlock new market opportunities, and keep you ahead of the competition. For more information on the significance of trade compliance and how it sets the foundation for global growth, check out this article: Why Trade Compliance Matters: Staying Ahead in a Global Marketplace.

What are the top reasons for customs holds?

While customs holds can be caused by a variety of factors, we’ve listed out a few of the most common issues when shipping internationally:

- Missing Shipment Information

- Incorrect Product Classification

- Unrealistically Low Customs Valuation

- Problematic Goods Descriptions

- Prohibited & Restricted Items

- Delayed Duty/Tax Payments

What is Passport’s Seller of Record® Program?

Passport Seller of Record® (SOR) is a solution designed to give brands a simpler way to handle VAT/GST compliance with a quick and seamless enrollment process. Under the SOR® program, companies will use Passport’s tax IDs to clear shipments, avoiding complex registrations and filings. As a merchant, you’ll simply collect VAT/GST at checkout, and Passport will manage the rest, including tax returns with the proper authorities and even monitoring sales thresholds that apply to certain countries.

Passport currently offers SOR® solutions in the following markets:

What's the difference between Seller of Record and Merchant of Record?

A third-party Merchant of Record solution acts as an intermediary and sells products on your behalf, assuming the responsibilities associated with financial transactions, tax compliance, and other regulatory requirements. On paper, they are legally recognized as the seller, meaning their company name will appear on bank and credit card statements.

A Seller of Record is a newer alternative that offers a more flexible approach to international tax compliance than a Merchant of Record. While offering a similar solution by enabling brands to outsource their indirect tax collection, reconciliation, and remittance to a third party, SOR® distinguishes itself by not being involved in financial transactions with customers. Instead, it allows merchants to choose their own payment platform and directly receive funds.

Passport offers both Merchant of Record services, as well as our unique Passport Seller of Record® service. To learn more about our SOR® services, visit https://passportglobal.com/seller-of-record/.

What are VAT and GST?

In the context of ecommerce, Value-Added Tax (VAT) and Goods & Services Tax (GST) are taxes levied by certain countries on the final consumption of goods and services. Although it’s ultimately paid by end customers, businesses typically collect VAT/GST at the point of sale and then remit the collected amounts to the governing authority in the consumer’s destination country.

VAT is the term commonly used in Europe, while other countries like Australia and New Zealand refer to it as GST. The variations between these international taxes come from the unique regulations each market imposes, including factors like tax rates, items that are tax-exempt, and registration requirements.

What is a distance selling threshold?

A distance selling threshold is a specific limit set by countries on the value of goods sold remotely by non-resident businesses, often through ecommerce transactions. When this threshold is exceeded, businesses must register for a tax ID and comply with local tax laws.

What is Duty Drawback and how can it benefit my brand?

Duty Drawback is a U.S. Customs program that allows you to recover up to 99% of duties, taxes, and fees paid on goods that are later exported. For ecommerce brands, this can mean reclaiming significant costs on returned or unsold international orders. Passport’s a licensed and permitted customs broker, with a team that helps manage the entire process so you can focus on growth, not paperwork.

Am I eligible for Duty Drawback if I ship with Passport?

If your brand ships internationally with Passport and your products are returned, unsold, or exported, you may be eligible for Duty Drawback. Our team reviews your shipments, handles all the required filings, and ensures compliance with U.S. Customs so you can get your refunds quickly and securely. To learn more about our Duty Drawback services, visit https://passportglobal.com/duty-drawback/.

What are tariffs, and how do they impact ecommerce brands?

Tariffs are government-imposed taxes on imported goods. For ecommerce brands, that means higher landed costs when sourcing products overseas or shipping cross-border. Changes to tariff policy can affect everything from your profit margins to your pricing strategy. Passport’s compliance experts track these shifts in real time — helping brands adapt quickly and stay compliant while protecting their bottom line.

What is the de minimis threshold, and why does it matter for DTC ecommerce?

The de minimis threshold is the value below which goods can enter a country duty- and tax-free. In the U.S., it was $800 — but that went away as trade policies evolve. For ecommerce brands, understanding de minimis rules is crucial: it determines whether your shipments are subject to duties, VAT, or customs clearance fees. Passport’s Seller of Record® and compliance solutions help you navigate these thresholds seamlessly, so every shipment clears correctly.

How could changes to the U.S. de minimis rule affect my business in 2025 and beyond?

The de minimis exemption came under renewed scrutiny as U.S. trade policy evolved under President Trump. The decision to eliminate the $800 threshold means more shipments are subject to duties — especially for DTC brands importing from China or shipping high-volume, low-value orders. To stay up to date on these developments, visit TrumpTradeTracker.com — Passport’s free, real-time tracker covering tariff and de minimis policy changes for ecommerce brands.

What steps can ecommerce brands take to reduce tariff exposure?

Start by auditing your supply chain and product classifications (HS codes) to ensure accuracy. Then explore opportunities for duty drawback, free trade agreements, or country-of-origin adjustments that may lower or refund duties. Passport’s licensed customs brokerage team helps identify savings opportunities while keeping your brand compliant with changing trade regulations.

Latest News and Articles

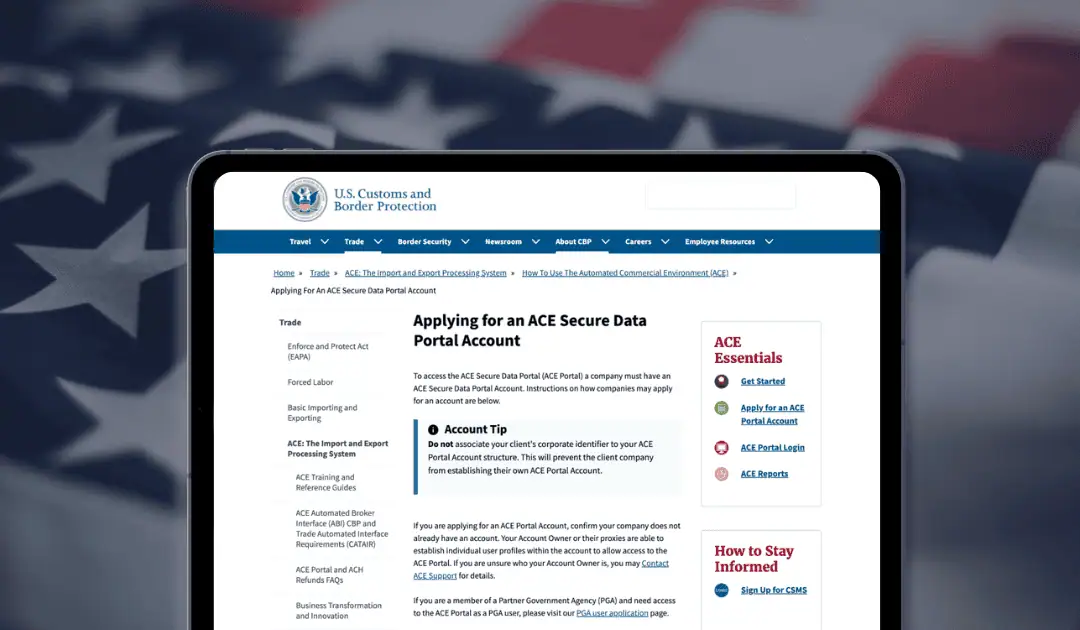

How to Get a CBP ACE Account

Step-by-step guide to getting a CBP ACE account. Learn how importers can verify eligibility, avoid signup delays, and access entry, duty, and liquidation data.

Reclaiming IEEPA Tariffs: A Practical Guide for U.S. Ecommerce Importers of Record

Learn how U.S. ecommerce importers of record can recover invalidated IEEPA tariffs. Step-by-step guidance on eligibility, deadlines, liquidation status, and filing protests or corrections.

Top Global Expansion Ecommerce Markets: Where U.S.-Based Brands Are Growing Next

An overview of the leading international ecommerce markets for U.S. brands, covering growth trends, tax frameworks, tariff updates, and operational considerations by region.

Trump Tariff Talk 2026: Navigating the Greenland Reversal, IEEPA Ruling, and New EU Handling Fees

Navigate the 2026 trade whiplash: Expert insights on the Greenland tariff reversal, IEEPA refund strategy, and new EU handling fees for e-commerce.